Loading

Get Uia Form 1772

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uia Form 1772 online

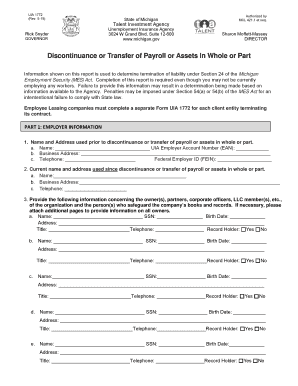

Filling out the Uia Form 1772 is a critical step for businesses that are discontinuing or transferring payroll or assets. This guide provides a simple, step-by-step process for completing the form online, ensuring that you have clear instructions at every stage.

Follow the steps to successfully complete the Uia Form 1772 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Complete Part 1: Employer Information. Fill out the name and address used prior to the discontinuance, along with the UIA Employer Account Number, telephone number, and Federal Employer ID.

- Provide the current name and address used since the discontinuance or transfer. Ensure to include updated contact details.

- List all owners, partners, and corporate officers. For each individual, provide their name, Social Security Number, birth date, address, title, telephone number, and indicate whether they are the record holder.

- Select the reason(s) for discontinuing or transferring payroll or assets by checking the appropriate boxes, such as sale, reorganization, or bankruptcy.

- Enter the date of discontinuance of payroll and the date of the last payroll processed.

- Indicate the number of business locations in Michigan and how many have been discontinued.

- Respond to questions regarding employment status and whether business operations have resumed in Michigan. Complete any additional information requested regarding business continuity.

- If applicable, complete Part II with information about the new owners who acquired the Michigan assets or business.

- In Part III, carefully detail the acquisition information, including the percentages of assets, organization, and trade acquired.

- Review all the entered information for accuracy and completeness. Make sure to sign and date the certification at the end of the form.

- After completing the form, you can save your changes, download it for your records, print it, or share it with relevant parties.

Complete your Uia Form 1772 online today and ensure compliance with the Michigan Employment Security Act.

The Michigan unemployment agency is currently facing two other class-action lawsuits alleging due process violations. A lawsuit filed in January claims the state unlawfully demanded pandemic benefits back and collected on overpayments caused by agency error.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.