Loading

Get Profit & Loss From Business Schedule C Data Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET online

This guide aims to provide you with clear and detailed instructions on how to successfully fill out the Profit & Loss from Business Schedule C data sheet online. By following the outlined steps, you will be able to gather and present your business-related tax information accurately.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

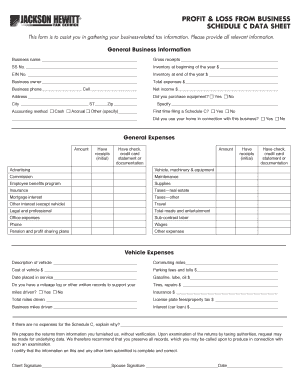

- Begin with the general business information section. Fill in your business name, gross receipts, and Social Security Number. Enter your Employer Identification Number (EIN) and indicate the inventory value at the beginning and end of the year.

- Complete the details of the business owner, including their name, contact information, and the total expenses incurred during the year.

- Indicate whether you purchased equipment by selecting the appropriate option. Specify equipment obtained if applicable.

- Choose your accounting method (cash, accrual, or other) and confirm if this is your first time filing a Schedule C.

- Indicate if you used your home for business purposes and provide details where necessary.

- Proceed to the general expenses section. Fill in the amount for each expense category, marking whether you have receipts or other documentation for verification.

- For vehicle expenses, enter the description of the vehicle, commuting miles, costs, parking fees, and the date the vehicle was placed in service. Provide supporting details regarding fuel and maintenance costs.

- Answer whether you have maintained a mileage log or other records to support the miles driven.

- If there are no expenses to claim on the Schedule C, provide an explanation in the designated area.

- Finally, certify that the information provided is complete and correct by signing the form. Ensure both parties, if applicable, sign and date the document.

- Once all sections are completed, save your changes, and proceed to download, print, or share the form as needed.

Start filling out your PROFIT & LOSS FROM BUSINESS SCHEDULE C DATA SHEET online today to ensure your business financials are accurately reported.

Key Takeaways That profit or loss is then entered on the owner's Form 1040 individual tax return and on Schedule SE, which is used to calculate the amount of tax owed on earnings from self-employment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.