Loading

Get Streamlined Sales And Use Tax Agreement - Wisconsin Certificate Of Exemption - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Streamlined Sales And Use Tax Agreement - Wisconsin Certificate Of Exemption - Revenue Wi online

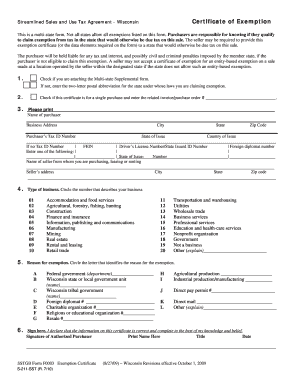

Filling out the Streamlined Sales And Use Tax Agreement - Wisconsin Certificate Of Exemption is essential for claiming exemption from sales tax in Wisconsin. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the exemption certificate.

- Press the ‘Get Form’ button to obtain the form and open it in the editable interface.

- Determine if you are attaching the Multi-state Supplemental form. If you are not, enter the two-letter postal abbreviation for Wisconsin to claim your exemption.

- Indicate if this certificate is for a single purchase, and enter the associated invoice or purchase order number. Complete the purchaser's name, business address, city, state, zip code, and the purchaser’s tax ID number.

- If you do not have a tax ID number, provide your Federal Employer Identification Number (FEIN), driver’s license number, or foreign diplomat number. Specify the state of issue for any identification provided.

- Identify the seller's name and their address, including city, state, and zip code.

- Select the type of your business by circling the number that best describes it. If your business does not fit any of the listed categories, circle the option for ‘Other’ and provide a brief explanation.

- Circle the letter that applies to the reason for your exemption and complete any additional information requested linked to that reason. If none of the provided reasons apply, circle ‘Other’ and detail your explanation.

- Provide your signature as the authorized purchaser, along with your printed name, title, and date of signing.

- After filling out the form, save your changes, and proceed to download, print, or share the completed exemption certificate as needed.

Complete your documents online confidently and ensure your tax exemptions are well managed.

Wisconsin has a pretty easy process—you'll just need to print out the Wisconsin Sales and Use Tax Exemption Certificate, add your businesses name and address, and under the Reason for Exemption section you'll check Resale and provide your Wisconsin seller's permit number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.