Loading

Get Form Tp-584.2: October 1996

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form TP-584.2: October 1996 online

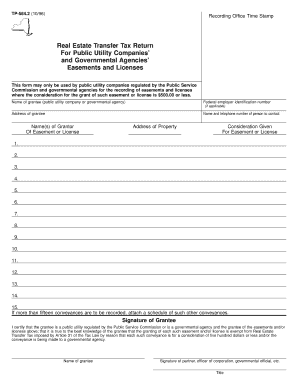

Filling out the Form TP-584.2: October 1996 can seem complicated, but this guide will lead you through each component systematically. This form is designated for public utility companies and governmental agencies to record easements and licenses with specific consideration limits.

Follow the steps to complete the Form TP-584.2 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the name of the grantee, which is the public utility company or governmental agency receiving the easement or license.

- If applicable, provide the federal employer identification number for the grantee in the designated field.

- Enter the address of the grantee in the respective field to ensure accurate correspondence.

- Fill in the name and telephone number of a contact person for the grantee to facilitate communications.

- List the names of the grantors of the easement or license in the specified section.

- Input the address of the property associated with the easement or license accurately.

- Indicate the consideration given for the easement or license, ensuring it does not exceed $500.00.

- If there are multiple conveyances to record, number them sequentially, up to fifteen, in the designated area.

- If additional conveyances exceed the fifteen listed, attach a schedule detailing these extra conveyances.

- Upon completion, the grantee must certify their status as a regulated public utility or governmental agency in the appropriate section.

- The designated representative of the grantee, such as a partner or governmental official, must sign and provide their title.

- Review all entered information for accuracy, ensuring all required fields are completed.

- Once verified, save changes to the form, then proceed to download or print it for submission.

- Share the completed form with relevant parties as necessary for processing.

Complete your Form TP-584.2 online today for efficient documentation.

Some counties in the US levy what is known as an "optional" transfer tax. ... A recording fee is normally a small flat amount while mortgage recording taxes are a percentage of the sale price, like transfer taxes. Taken together, all these fees can end up constituting a significant chunk of your mortgage closing costs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.