Get Letter 1125 (rev. 10-2008). Transmittal Of Examination Report - Eitc Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Letter 1125 (Rev. 10-2008). Transmittal Of Examination Report - Eitc Irs online

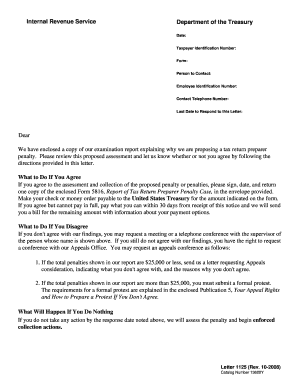

Filling out the Letter 1125 (Rev. 10-2008) is an important step in responding to an examination report from the IRS. This guide provides clear and detailed instructions for completing the form online, ensuring users can effectively communicate their agreement or disagreement.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Review the headings on the form. Make sure to fill in the Date, Taxpayer Identification Number, Form number, and Employee Identification Number accurately.

- In the 'Person to Contact' section, include the name of the IRS representative if available, along with their contact telephone number.

- For the 'Last Date to Respond to this Letter,' ensure you enter the date provided in your communication from the IRS.

- If you agree with the IRS findings, check the box indicating your agreement and sign and date the form appropriately. Prepare to return one copy of Form 5816, as indicated in the letter.

- If you disagree, prepare to either request a meeting or a telephone conference with the IRS supervisor listed on the letter. Note your reasons for disagreement.

- Finally, after completing the necessary fields and ensuring all information is correct, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online today to ensure compliance and clarity in your communications.

Federal Earned Income Tax Credit (EITC) The notification will be provided within one week before, after, or during the time the employer provides an annual wage summary, including, but not limited to, Forms W-2 or 1099, to the employee. Required Notices and Pamphlets - EDD - CA.gov ca.gov https://edd.ca.gov › payroll_taxes › required_notices_an... ca.gov https://edd.ca.gov › payroll_taxes › required_notices_an...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.