Loading

Get You Must Obtain An End User Number From The Comptrollers Ofce

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the You Must Obtain An End User Number From The Comptrollers Office online

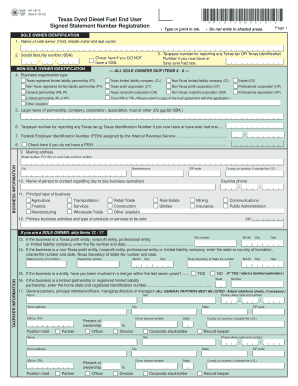

This guide provides step-by-step instructions for obtaining an End User Number from the Comptroller's Office in Texas. Whether you are a sole owner, partnership, or corporation, the process of filling out the associated form can be straightforward with the right guidance.

Follow the steps to complete your End User Number registration.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by entering your identification details in Item 1 if you are a sole owner. Include your first name, middle initial, and last name.

- In Item 2, provide your Social Security number (SSN). If you do not have an SSN, check the appropriate box.

- For Items 3-8, only if applicable, report your Texas taxpayer number or Texas Identification Number, business organization type, legal name, and Federal Employer Identification Number (FEIN) if required.

- In Item 9, fill in your complete mailing address where you wish to receive correspondence from the Comptroller of Public Accounts.

- If relevant, provide information for the principal officer(s) in Items 10-17, listing details such as the name, title, and SSN or ITIN.

- Proceed to Item 18 and confirm the legal name of your entity if applicable.

- In Item 19, enter the business location name and address, ensuring you provide specific physical location directions if needed.

- Complete Items 20-24 by specifying fuel use type, storage information, and signatures required from the owner or authorized representatives.

- Finally, review all provided information for accuracy before saving changes, downloading, printing, or sharing the completed form.

Start your registration process online today to obtain your End User Number.

AUSTIN, Texas — On Friday the Internal Revenue Service (IRS) announced it will not impose a penalty when dyed diesel fuel is sold for use or used on the highway in the State of Texas. The IRS said this relief is retroactive to Feb. 12, 2021 and will remain in effect through Feb. 26, 2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.