Loading

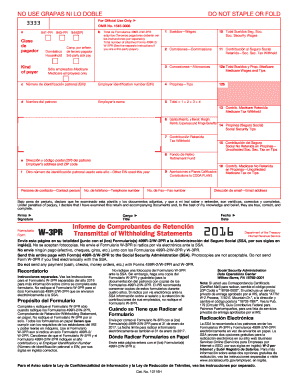

Get 2016 Form W-3 Pr Transmittal Of Withholding Statements Puerto Rico - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 Form W-3 PR Transmittal of Withholding Statements Puerto Rico - IRS online

Filling out the 2016 Form W-3 PR is a crucial part of complying with tax requirements in Puerto Rico. This guide will provide you with clear, step-by-step instructions for completing this form online, ensuring you have all the necessary information at your fingertips.

Follow the steps to complete the form accurately

- Click the ‘Get Form’ button to access the Form W-3 PR. This will allow you to open the form in an interactive format that can be filled out online.

- Identify the 'kind of payer' by selecting the appropriate box. This section categorizes the type of entity you represent.

- Enter the total number of attached Forms 499R-2/W-2PR. Ensuring accuracy here is essential, as it correlates directly with the documentation you will submit.

- Complete the fields for wages, commissions, allowances, and tips, as applicable. Calculate the total amounts for each category, ensuring that the summations are accurately reflected.

- Fill in the Employer Identification Number (EIN) and the employer's name, address, and contact information. Make sure that these details are consistent across all forms submitted.

- Complete the sections for Social Security and Medicare taxes withheld. Enter all necessary amounts as specified in the respective fields.

- Review the form carefully. Ensure that all entries are correct and that all required fields have been completed. Take the time to cross-check information against your records.

- Save your changes to the completed form. Once you have finished, you can download, print, or share the form as needed for your records or to file with the relevant authority.

Complete your tax documents online today to ensure compliance and accuracy.

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.