Loading

Get Application For Sales Tax Exemption For Colorado Organizations - Colorado

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Sales Tax Exemption For Colorado Organizations - Colorado online

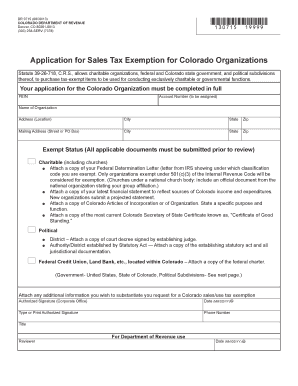

This guide provides an easy-to-follow process for filling out the Application for Sales Tax Exemption for Colorado Organizations. Designed for organizations looking to obtain a sales tax exemption, the steps outlined here will ensure that you complete the application efficiently and correctly.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to download the application form and open it in your preferred online document editor.

- Begin by filling in the Federal Employer Identification Number (FEIN) and the account number (to be assigned to you).

- Provide the name of your organization, and then fill in the 'Address' section, including the city, state, and zip code of the physical location.

- Complete the 'Mailing Address' section. If your mailing address differs from the physical address, include the street or P.O. Box, city, state, and zip code.

- Indicate your exempt status. If you are a charitable organization, attach the required documents including your Federal Determination Letter, financial statements, and Colorado Articles of Incorporation.

- If applicable, submit documentation specific to your political district or federal credit union to demonstrate your eligibility for exemption.

- Add any additional information that supports your request for tax exemption, ensuring to provide a clear explanation of your organization’s purpose.

- Include the authorized signature from your corporate office along with the date, printed name, phone number, and title of the signing individual.

- Review all information for accuracy, and then save your changes. You can choose to download, print, or share the completed form as necessary.

Complete your Application for Sales Tax Exemption online today to ensure your organization receives the necessary tax benefits.

Standard Colorado Affidavit of Exempt Sale This form is required by the State of Colorado for any transaction on which an exemption from state tax is claimed for charitable and government entities. The seller is required to maintain a completed form for each tax-exempt sale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.