Loading

Get Form Nys-1-mn:1/10: Return Of Tax Withheld: Nys1mn - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NYS-1-MN:1/10: Return Of Tax Withheld: NYS1MN - Tax Ny online

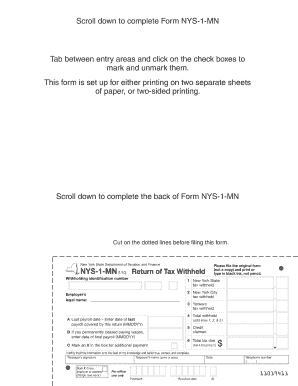

Filing the Form NYS-1-MN: Return Of Tax Withheld is an important task for employers in New York to ensure that tax obligations are met. This guide provides clear, step-by-step instructions on how to complete the form online, making the process straightforward and efficient.

Follow the steps to complete your tax withholding form online.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter your withholding identification number, which is necessary for processing the form accurately.

- Fill in the employer’s legal name to ensure proper identification for your business.

- Complete lines 1, 2, and 3 to indicate the amounts of New York State tax withheld, New York City tax withheld, and Yonkers tax withheld, respectively.

- Input the date of the last payroll covered by this return in MMDDYY format in section A.

- If applicable, enter the date of your final payroll in section B, formatted as MMDDYY.

- If you have made any additional payments, mark an X in the designated box.

- Calculate the total withheld amount by adding the figures from lines 1, 2, and 3, and enter the result on line 4.

- If claiming any credits, indicate the amount on line 5.

- Determine the total tax due by subtracting the credit claimed from the total withheld and enter this figure on line 6.

- Certify the accuracy of your information by signing the form, providing your printed name, date, and telephone number.

- If using a paid preparer, have them complete their section, including their signature, contact details, and firm name.

- Review all entries for accuracy, then save your changes and choose to download or print the completed form.

- Finally, mail the original form to the address specified for tax submission, ensuring it is sent in a timely manner.

Complete your tax documents online today to ensure compliance and avoid any penalties.

Form NYS-1, Return of Tax Withheld, must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.