Loading

Get Tc 62m Schedule A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC-62M Schedule A online

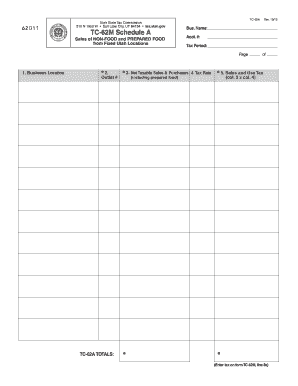

Filling out the TC-62M Schedule A online is an important step for businesses that sell non-food and prepared food from fixed locations in Utah. This guide provides clear, step-by-step instructions to help you successfully complete the form and ensure accurate reporting.

Follow the steps to complete the TC-62M Schedule A online.

- Click ‘Get Form’ button to access the TC-62M Schedule A and open it for editing.

- In the first section, enter your business name, account number, and the tax period for which you are filing. This information will help identify your business's sales activity during the specified time frame.

- In column 1, you will see preprinted locations derived from the Tax Commission’s records. Verify these locations and make any necessary corrections, such as adding new business locations or removing those that are closed. Be sure to include the start or closing dates for these adjustments.

- Column 2 contains outlet numbers assigned by the Tax Commission. If you do not have this information, obtain it by registering online with the Taxpayer Access Point (TAP) or contacting the Tax Commission for assistance.

- In column 3, enter the net taxable sales and purchases for non-food and prepared food items for each listed location. Ensure these figures are accurately included in your total taxable sales on the TC-62M form, line 7.

- Column 4 provides the preprinted tax rate for each business location. Confirm these rates by visiting the Utah Tax Commission’s website, as they may change quarterly.

- For column 5, calculate and enter the total sales and use tax by multiplying the amounts from column 3 by the corresponding tax rate in column 4. Ensure that you add these amounts and report the total on TC-62M, line 8a.

- At the bottom of the last page, add up the amounts from column 3 and column 5. Make sure this total is included in the appropriate lines on the TC-62M form.

- Once all sections are complete, you can save your changes, download a copy, print the form, or share it as needed.

Complete your TC-62M Schedule A online for efficient tax filing.

What is the expiration date for my current Sales tax license? Sales tax licenses are issued yearly and are valid January - December of the tax year listed on the license.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.