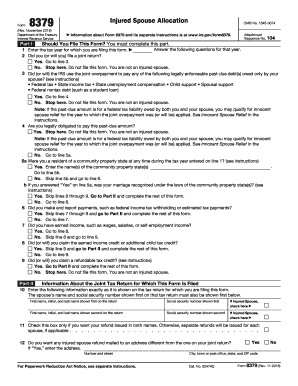

Get February 2015) Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the February 2015 Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation online

This guide provides clear and comprehensive instructions on completing the February 2015 Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation form online. This form is essential for individuals who need to claim injured spouse status and ensure their tax refund is not offset by their partner's debts.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to access the form and open it in your preferred PDF editor.

- Enter the tax year for which you are completing this form in the specified field.

- Indicate whether you will file a joint return. If 'Yes', proceed to line 3; if 'No', you do not qualify as an injured spouse.

- Specify if the IRS will use the joint overpayment to satisfy any legally enforceable past-due debts owed solely by your partner. If 'No', you do not qualify as an injured spouse.

- Determine if you are legally obligated to pay the mentioned past-due amount. If 'Yes', stop here; you are not an injured spouse.

- Indicate if you were a resident of a community property state during the tax year. If 'Yes', provide the state names and continue; if 'No', skip to line 6.

- If you answered 'Yes' to being in a community property state, specify if your marriage is recognized. If 'Yes', skip to Part II; if 'No', continue.

- Indicate if you made and reported payments to tax withholdings or estimated payments. If 'Yes', skip to Part II; if 'No', continue.

- State if you had earned income during the year. If 'Yes', proceed; if 'No', continue.

- Indicate whether you will claim the earned income credit or additional child tax credit. If 'Yes', skip to Part II; if 'No', continue.

- Specify if you will claim any refundable tax credits. If 'Yes', proceed to Part II; if 'No', you do not qualify as an injured spouse.

- In Part II, enter the information about the joint tax return exactly as it appears on your tax documents.

- Complete the Profit and Loss from Business section if printing the form, ensuring all entries are accurate.

- Review all the entries for correctness before finalizing.

- Once completed, save, download, print, or share the form as needed.

Start filling out the injured spouse allocation form online today to ensure your tax refund is properly allocated.

The allocation instructions are as follows: The wages should be allocated to each spouse as shown on their W-2 forms. The taxes withheld must also be divided as shown on the W-2 forms. The Standard or Itemized deductions must be allocated so that the non-injured spouse would be able to file as if they were single.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.