Loading

Get Clear Form State Of Hawaii Department Of Taxation Schedule J Form N-11/n-15/n-40 (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION SCHEDULE J FORM N-11/N-15/N-40 (REV online

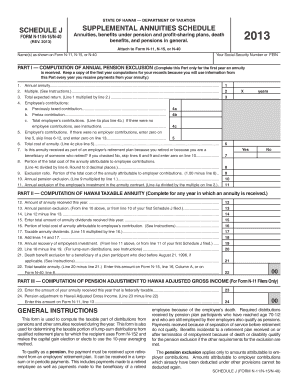

Filling out the Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION SCHEDULE J is an essential step in determining the taxable portion of annuities and pensions. This guide will provide clear instructions to assist you in accurately completing the form online.

Follow the steps to complete your Schedule J form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as they appear on Form N-11, N-15, or N-40, followed by your Social Security Number or Federal Employer Identification Number (FEIN).

- In Part I, compute the annual pension exclusion. Start with the annual annuity amount you receive each year. If you have received only a partial distribution, calculate the annualized amount.

- Enter the multiple used for federal purposes on Line 2 to calculate the expected return on your annuity.

- Complete Line 4 by detailing your employee contributions, noting previously taxed contributions (Line 4a) and pretax contributions (Line 4b). Add these for the total contributions to be recorded on Line 4c.

- Record employer contributions on Line 5, entering zero if none were made. Proceed to total the cost of the annuity in Line 6, which adds your contributions to those from the employer.

- Determine if your annuity is part of an employer's retirement plan. If applicable, fill out Lines 8 through 10 to calculate the exclusion ratio and annual pension exclusion.

- In Part II, for the year you received the annuity, record the amount of total annuity received this year on Line 12. Follow up with the annual pension exclusion on Line 13.

- Heed Lines 14 through 22 to calculate the taxable portion of your annuity distributions, ensuring to note any death benefit exclusions if relevant.

- If you are a Form N-11 filer, complete Part III to compute the pension adjustment to your Hawaii adjusted gross income, filling in Lines 23 and 24.

- Once all sections are filled out, save your changes, download the completed form, and proceed to print or share it as required.

Complete your Schedule J form online to ensure accurate reporting of your annuities and pension benefits.

Each year, a nonresident who earns income from Hawaiʻi sources must file a State of Hawaiʻi tax return and will be taxed only on income from Hawaiʻi sources. If the person has not received taxable income from a Hawaiʻi source during the past calendar year, a state tax return does not need to be filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.