Loading

Get Johns Creek Business Occupation Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Johns Creek Business Occupation Tax Return online

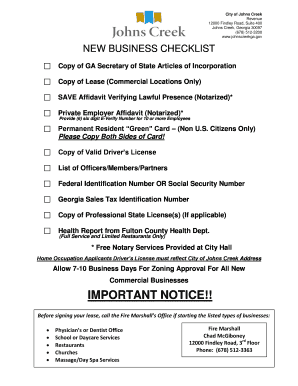

Filing the Johns Creek Business Occupation Tax Return online is an essential step for businesses commencing operations in Johns Creek. This guide will provide clear and supportive instructions on how to accurately complete the form to ensure compliance with local regulations.

Follow the steps to complete the necessary tax return form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the control number and your business name or DBA. Ensure that the business name matches any registration documents.

- Provide the location address, including suite/unit, city, state, and ZIP code. Make sure this is where the business operates.

- Enter your phone number and mailing address if it differs from the location address.

- Select the type of ownership by checking one of the options: sole proprietor, partnership, corporation, LLC, foreign corporation, or other.

- Input the corporate or owner name and address for all applicable business types.

- Indicate the date your business commenced operations in Johns Creek.

- Answer questions related to state license requirements, whether the business is home-based, and other relevant classifications.

- Provide an industry description and the NAICS code that corresponds to your business activities.

- Estimate your gross receipts for the calendar year and outline allowable deductions to calculate taxable gross receipts.

- Calculate the occupation tax based on your taxable gross receipts and include any applicable fees.

- Review your entries for accuracy, and sign the tax return certifying that all information is complete and correct.

- After completing the form, you may save changes, download, print, or share the form as needed.

Complete your Johns Creek Business Occupation Tax Return online today to ensure compliance and smooth business operations.

Fulton County's sales tax is 7.75 percent, collected on all retail sales except food. This includes a four percent statewide sales tax, one percent MARTA tax, one percent education tax, one percent local option tax and .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.