Loading

Get Use Tax Return And Instructions (pa-1). Forms/publications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Use Tax Return And Instructions (PA-1) online

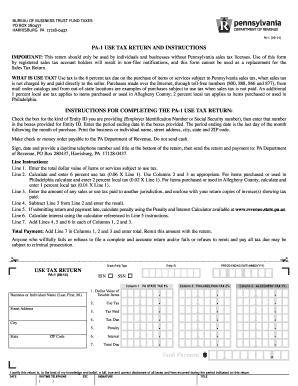

The Use Tax Return and Instructions (PA-1) is a vital document for individuals and businesses in Pennsylvania without sales tax licenses. This guide provides a step-by-step approach to assist users in accurately completing the form and ensuring compliance with tax obligations.

Follow the steps to fill out the Use Tax Return And Instructions (PA-1) effectively.

- Press the ‘Get Form’ button to access the Use Tax Return and Instructions (PA-1) form and view it in the editor.

- Select the type of Entity ID you are providing by checking the appropriate box (Employer Identification Number or Social Security Number) and enter that number in the designated boxes.

- Input the period ending date, which is the last day of the month following the month of purchase, in the specified space.

- Clearly print your business or individual name, along with your street address, city, state, and ZIP code.

- Complete Line 1 by entering the total dollar value of items or services that are subject to use tax.

- In Line 2, calculate the 6 percent use tax by multiplying Line 1 by 0.06, and fill in the respective amounts in Columns 1, 2, and 3. Additionally, compute any local tax that applies: 2 percent for Philadelphia and 1 percent for Allegheny County.

- For Line 3, enter any sales or use tax you have paid to another jurisdiction and attach copies of invoices showing the tax paid.

- Subtract Line 3 from Line 2 for Line 4 and enter the result.

- If submitting late, calculate the penalty using the Penalty and Interest Calculator as instructed on the form and enter on Line 5.

- Calculate interest for any late payment, using the same calculator mentioned in the previous step, and input this in Line 6.

- Add Lines 4, 5, and 6 across all columns to complete Line 7.

- Compute the Total Payment by adding up Line 7 from all columns and enter the final total.

- Ensure to sign and date the form, providing a daytime telephone number and your title at the bottom.

- Finally, submit your completed return along with payment to the PA Department of Revenue at the specified mailing address.

Complete your Use Tax Return and file online to stay compliant with Pennsylvania tax regulations.

Staple all your forms and schedules together in the upper left corner. Attach W-2 and 1099 income documents. You'll receive a few copies of each income document that's mailed to you. Find the federal copy of each form and staple them to the front of your 1040 in the income section.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.