Loading

Get Vat103

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat103 online

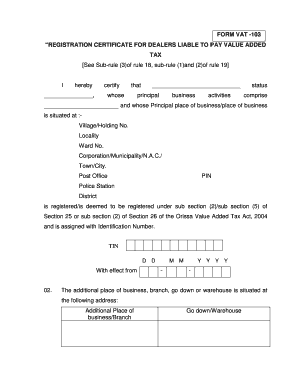

The Vat103 form is essential for dealers who are required to pay value added tax. This guide provides a step-by-step approach to help you navigate and complete the form online effectively.

Follow the steps to accurately complete the Vat103 form online.

- Press the ‘Get Form’ button to access the Vat103 form and open it in your preferred editor.

- Fill in your name in the designated field that certifies your details.

- Complete the section regarding the principal business activities. Mention the primary nature of your business operations.

- Provide your principal place of business details, including village or holding number, locality, ward number, and city or municipality.

- Enter the postal details including post office and PIN code associated with your business address.

- Specify the police station and district where your principal place of business is located.

- Indicate whether you are registered or deemed to be registered under the specific sections of the Orissa Value Added Tax Act, 2004, and provide your Tax Identification Number (TIN).

- Complete the section regarding the effective date of registration using the provided format (DD/MM/YYYY).

- If applicable, list any additional places of business, branches, warehouses, or go downs, providing their respective addresses.

- Detail the goods that you purchase or intend to purchase aside from those meant for resale. Make sure to categorize them appropriately.

- List capital goods, raw materials, consumables, fuels, and packing materials that are purchased for direct manufacturing.

- Enumerate any bye-products manufactured for sale, distinguishing between taxable and tax-free categories.

- Identify goods intended for use in works contracts, providing descriptions for each item.

- Review the completed form thoroughly, ensuring no sections are left blank, and correct any inaccuracies.

- Lastly, save your changes, and if needed, download, print, or share the completed form.

Start filling out your Vat103 form online today!

The online registration for VAT in UAE can be done through the VAT registration portal available on the website of www.tax.gov.ae.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.