Loading

Get Form St-7 Virginia Business Consumer S Use Tax Return ... - Tax Virginia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-7 Virginia Business Consumer S Use Tax Return online

Filling out the Form ST-7 Virginia Business Consumer S Use Tax Return is crucial for businesses to report their use tax obligations accurately. This guide provides detailed, step-by-step instructions to help you navigate the form with ease.

Follow the steps to complete the Form ST-7 successfully.

- Click ‘Get Form’ button to download the form and open it in your document editor.

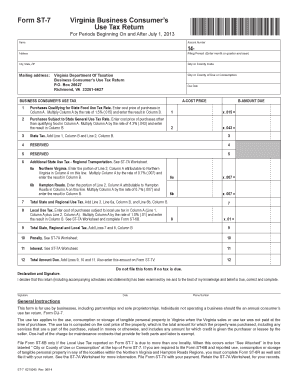

- Enter your name, account number, and address at the top of the form. Provide the filing period, including the month or quarter and year.

- Specify the city, state, and ZIP code, and include the city or county code as required for your jurisdiction.

- Fill in the city or county of use or consumption along with the due date for the return.

- Column A of the form requests the cost price of your purchases. Start by entering the total for purchases that qualify for the reduced state food use tax rate in Line 1.

- In Column B of Line 1, multiply the cost price from Column A by 1.5% (.015) to determine the amount due.

- Proceed to Line 2 for purchases that are subject to the state general use tax rate. Enter the total cost price in Column A.

- In Column B of Line 2, multiply the cost price from Column A by 4.3% (.043) to get the amount due.

- For Line 3, sum the amounts in Column B from Lines 1 and 2 to calculate the total state tax due.

- If applicable, complete Lines 6a and 6b for additional state use tax related to Northern Virginia and Hampton Roads regions, as instructed.

- Continue to Line 8 for local use tax; sum the cost of purchases in Column A and multiply by the local rate of 1.0% (.01).

- Add Lines 7 and 8 from Column B for a total state, regional, and local tax in Line 9.

- Calculate any penalties and interest if applicable in Lines 10 and 11, then sum these with Line 9 to find the total amount due on Line 12.

- Declare and sign the form, including your date and phone number to confirm the accuracy of the return.

- Save your changes, download a copy, and print the completed form. Share it or prepare it for mailing as directed.

Complete and submit your Form ST-7 online to ensure compliance with Virginia tax regulations.

If you discover mistakes after you have filed and you need to submit an amended return, you may complete a new tax return through eForms and mark the "amended return" checkbox. See "Amending an eForm" below for more details. Filing an amended eForm does not override or cancel any returns you previously submitted.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.