Loading

Get Dbs Self Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dbs Self Certification online

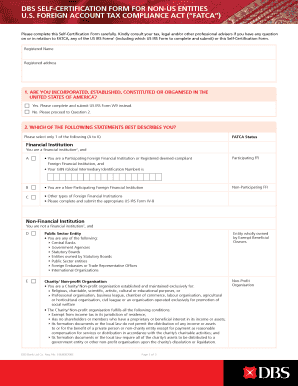

The Dbs Self Certification form is an essential document for non-US entities under the U.S. Foreign Account Tax Compliance Act (FATCA). This guide provides step-by-step instructions on how to complete the form online, ensuring accuracy and compliance.

Follow the steps to successfully complete the Dbs Self Certification form.

- Click the ‘Get Form’ button to access the Dbs Self Certification form online.

- Begin by entering the registered name of your entity in the designated field.

- Provide the complete registered address of your entity to ensure accuracy.

- Answer the initial question: Are you incorporated, established, constituted or organized in the United States of America? Select 'Yes' or 'No' as applicable. If 'Yes,' further instructions will guide you to complete a different form (US IRS Form W-9). If 'No,' proceed to the next question.

- Choose the statement that best describes your entity’s FATCA status. You must select only one from the list provided (Options A to K) that accurately reflects your status.

- If you selected Option J (Passive Investments), fill in the details of substantial US owners who own at least 25% of your entity as required in the additional fields provided.

- At the end of the form, ensure that all provided information is accurate and complete.

- Sign the form as required. Ensure that all authors of the form are duly authorized to complete and sign it on behalf of your entity.

- Save your changes, and remember to download, print, or share the completed form as necessary for your records.

Complete your Dbs Self Certification form online today for compliance and to avoid potential tax-related penalties.

Related links form

Under the city-state's tax residency rules, a foreigner is regarded as a tax resident if he or she stays or works in Singapore for at least 183 days in a calendar year. Notably, the number of counted days includes weekends and public holidays, and any temporary absence from work for overseas vacation or official work.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.