Loading

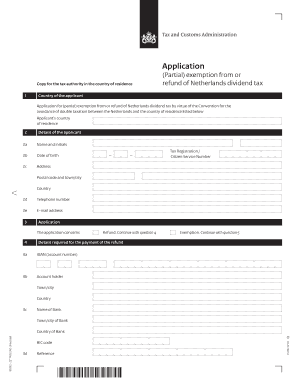

Get Application (partial) Exemption From Or Refund Of Netherlands Dividend Tax. Ib 092 - 2z*7fol Eng

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Application (Partial) Exemption From Or Refund Of Netherlands Dividend Tax. IB 092 - 2Z*7FOL ENG online

Filling out the Application (Partial) Exemption From Or Refund Of Netherlands Dividend Tax, IB 092 - 2Z*7FOL ENG, is essential for individuals seeking to reclaim or receive exemptions from dividend tax in the Netherlands. This guide provides clear, step-by-step instructions to help users navigate the process effectively and accurately.

Follow the steps to complete your application smoothly.

- Click ‘Get Form’ button to access the application form and open it in the editor.

- In the first section, provide your country of residence. This information is crucial for establishing eligibility under the relevant tax treaty between the Netherlands and your home country.

- Fill out your personal details in 'Details of the applicant.' This includes your name, date of birth, address, telephone number, and email address. Ensure all information is accurate to prevent delays.

- In the 'Application' section, indicate whether you are applying for a refund or exemption by choosing the appropriate option.

- For a refund application, enter your IBAN and the account holder's name along with the corresponding bank details. If applying for an exemption, skip to the next section.

- Complete any required details regarding the exemption or refund, including the name of the paying company, payment date, and gross amount of the dividend. Clearly state the amount claimed.

- Sign and date the application in the 'Statement and signature of the applicant' section. Ensure you declare that you meet all conditions stipulated by the law and tax treaty.

- The form must be certified by the tax authority in your country of residence, who will keep one copy and return another to you for your records.

- Once completed, you can save changes, download, print, or share your application form with the appropriate authorities.

Start your application process online today and make sure to complete all necessary fields for a successful submission.

Dividends are subject to tax. The general rate of dividend tax is 15%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.