Loading

Get Addendum Form Dte 105g - Franklin County Auditor - Ashtabulacountyauditor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Addendum Form DTE 105G - Franklin County Auditor - Ashtabulacountyauditor online

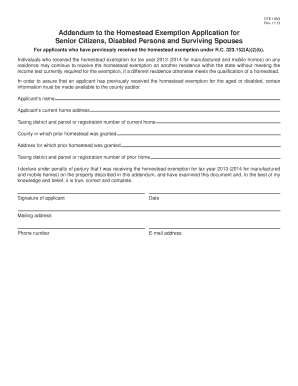

This guide provides comprehensive instructions on filling out the Addendum Form DTE 105G, which is necessary for individuals who have previously received the homestead exemption. By following these steps, users will complete the form accurately and efficiently online.

Follow the steps to successfully complete your addendum form.

- Click the ‘Get Form’ button to access the addendum form and open it in your preferred document editor.

- Begin by entering the applicant’s name in the designated field. Ensure that the name matches the identification documents to avoid any discrepancies.

- Provide the current home address of the applicant, including street number, street name, city, state, and zip code.

- Fill in the taxing district and the parcel or registration number of the current home. This information can typically be found on the property tax statement.

- Indicate the county where the prior homestead exemption was granted. Ensure this matches the records for correct processing.

- Input the address for which the prior homestead exemption was granted, similar to how the current address was entered.

- Provide the taxing district and parcel or registration number for the prior home that had the homestead exemption. Accuracy is essential here.

- Read the declaration statement carefully. By signing this form, you affirm under penalty of perjury that the information provided is true and correct to the best of your knowledge.

- Sign and date the form in the appropriate section to validate your submission.

- Include your mailing address, phone number, and email address in the specified fields for future correspondence regarding your application.

- Once all fields are complete, review the form for any errors, save your changes, and proceed to download, print, or share the completed form as needed.

Start completing your Addendum Form DTE 105G online today to ensure you maintain your homestead exemption.

The limit for tax year 2020 (payable 2021) is $33,600 (Ohio adjusted gross income - line 3 on tax return). For 2021 (payable 2022) the limit is $34,200. (Homestead recipients prior to 2014 are not subject to the income test).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.