Loading

Get Remittance Form - Uutinfo.org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Remittance Form - UUTInfo.org online

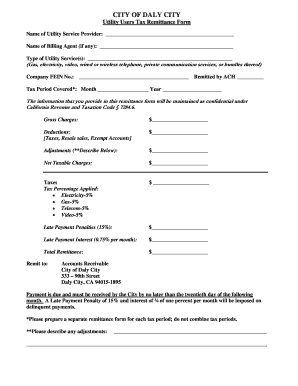

Completing the Remittance Form is a crucial step for utility service providers to ensure compliant tax remittance. This guide will provide you with clear, step-by-step instructions to successfully fill out the form online.

Follow the steps to complete the remittance form accurately.

- Press the ‘Get Form’ button to access the Remittance Form and open it for editing.

- In the first section, enter the name of your utility service provider in the space provided. If a billing agent is involved, fill in their name as well.

- Specify the type of utility services provided by checking the appropriate options. These can include gas, electricity, video, wired or wireless telephone, or private communication services.

- Input your Company FEIN number in the designated field.

- Indicate if the remittance is being made by ACH by marking the relevant checkbox.

- Select the tax period you are remitting for by entering the month and year in the provided fields.

- Fill in the gross charges amount under 'Gross Charges'. This is the total amount you are remitting before any deductions or adjustments.

- If applicable, enter any deductions such as taxes, resale sales, or exempt accounts.

- If there are any adjustments, specify them in the appropriate field along with a brief description.

- The net taxable charges are calculated automatically based on the gross charges, deductions, and adjustments. Ensure this is accurate.

- Calculate and enter the applicable tax amount using the specified percentages for electricity, gas, telecom, and video services.

- If applicable, include any late payment penalties or interest charges in the respective fields.

- Finally, calculate the total remittance amount and ensure it is correctly entered.

- Review all entered information for accuracy. Once verified, you may save your changes, download, print, or share the completed form as necessary.

Get started now and complete your Remittance Form online for efficient tax compliance.

Payment remittance is a money exchange using a transfer. One party will send funds to another individual or entity, typically using electronic transfer or wire submission. Transactions of this kind are often done internationally and can be completed almost immediately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.