Loading

Get Notification Of Employment After Retirement Form Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notification Of Employment After Retirement Form NJ online

This guide provides clear and comprehensive instructions for filling out the Notification Of Employment After Retirement Form NJ online. Whether you are an employer hiring someone who is receiving retirement benefits or simply need guidance, this step-by-step approach will support you through the process.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it for completion.

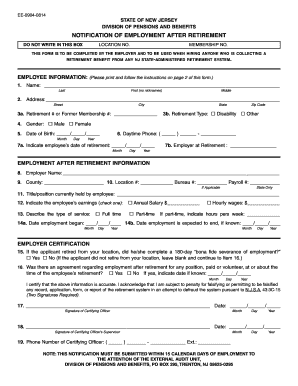

- In the Employee Information section, enter the employee’s full name, including last, first, and middle initial, ensuring no nicknames are used.

- Provide the employee’s current mailing address, including street, city, state, and zip code.

- Enter the retirement number or former membership number of the employee as applicable.

- Indicate the type of retirement by checking the appropriate box for either disability or other type.

- Select the gender of the employee by marking the corresponding checkbox.

- Fill in the date of birth for the employee in the format of month/day/year.

- Enter the employee's daytime phone number, ensuring the area code is included.

- Indicate the date of retirement and the employer at the time of retirement.

- In the Employment After Retirement Information section, enter the employer's name and the county of the employer.

- Provide the location number, bureau number, and payroll number where applicable.

- Specify the title or position currently held by the employee and add whether the individual is an employee or independent contractor.

- Indicate the employee's earnings and check whether they are full-time or part-time.

- Record the dates for when employment began and when it is expected to end, if known.

- Certify the information provided by ensuring the certifying officer and the officer’s supervisor sign and date the form.

- Include the phone number of the certifying officer, ensuring all required details are complete.

- Review the completed form thoroughly before submitting.

- Once all sections are complete, save changes, download, print, or share the form as needed.

Complete your form online to ensure a smooth processing experience.

A. You can continue working and start receiving your retirement benefits. If you start your benefits before your full retirement age, your benefits are reduced a fraction of a percent for each month before your full retirement age.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.