Loading

Get Self-employment (short) (2018). If You 're Self-employed, Have Relatively Simple Tax Affairs And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self-employment (short) (2018) form online

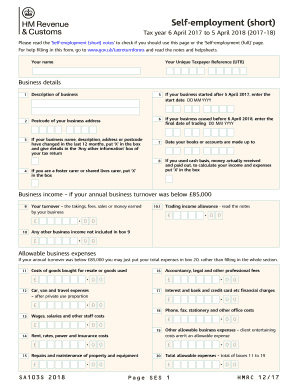

This guide will help you navigate the Self-employment (short) (2018) form, designed for individuals who are self-employed and have relatively simple tax affairs. By following these steps, you can efficiently complete your tax obligations online.

Follow the steps to successfully complete your Self-employment (short) (2018) form.

- Click the ‘Get Form’ button to obtain the form and open it in a suitable editor. Make sure you have a stable internet connection to download the document.

- Begin by entering your name in the designated field. This should match the name as it appears on official documents.

- Provide your Unique Taxpayer Reference (UTR), which is a 10-digit number unique to you.

- Next, fill in the business details. Describe your business clearly in the space provided. If your business started after 5 April 2017, enter the start date in the format DD MM YYYY.

- Indicate the postcode of your business address in the corresponding field.

- If any business name, description, address, or postcode has changed in the last 12 months, mark the box and provide further details in the 'Any other information' section.

- Record the date your books or accounts are made up to in the appropriate field.

- If you used cash basis for calculating your income and expenses, mark the corresponding box.

- If applicable, indicate whether you are a foster carer or shared lives carer by marking the relevant box.

- Enter your business turnover. This is the total amount earned through sales and services in a year.

- In the next fields, include any trading income allowance and additional business income not listed in the turnover.

- Input your allowable business expenses. If your turnover was below £85,000, sum your expenses and enter the total in box 20 instead of filling out each individual category.

- Complete the sections for different types of allowable expenses, including costs of goods bought for resale, travel expenses, staff costs, rent, and other related expenditures.

- Calculate your net profit or loss by reviewing the provided boxes carefully. Fill in box 21 or box 22 as determined by your income and expenses.

- If you have applicable capital allowances, ensure they are filled out correctly.

- Summarize your taxable profits or losses at the end of the section and ensure all calculations are accurate.

- If you've made a loss, follow the instructions to enter details regarding loss offsets, NICs, and any other relevant fields.

- Finally, review all the information for completeness and correctness. Save your changes, then download, print, or share the completed form as needed.

Start completing your Self-employment (short) (2018) form online today to stay on top of your tax responsibilities.

Annual Tax Returns A federal income tax return is conclusive proof of all your earnings within the year. This legal document, which shows your total income for the year and is filed at the IRS, is perhaps the most credible proof of income documentation you can show if you're self-employed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.