Loading

Get Inherited Retirement Account Distribution Request (ira-10g)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inherited Retirement Account Distribution Request (IRA-10G) online

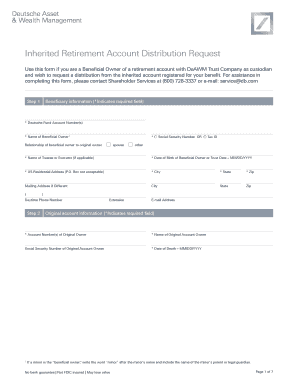

The Inherited Retirement Account Distribution Request (IRA-10G) is a crucial form for beneficiaries seeking to request distributions from inherited retirement accounts. This guide provides clear, step-by-step instructions to help users navigate the online form completion process efficiently.

Follow the steps to fill out the IRA-10G online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the beneficiary information section. Fill in your Deutsche Fund Account Number(s), your name as the Beneficial Owner, and select whether to use your Social Security Number or Tax ID. Specify your relationship to the original account owner, and if applicable, provide the name and date of birth of the Trust or Trustee. Complete your US residential address (note that a P.O. Box is not acceptable) and provide a daytime phone number.

- Proceed to the original account information section. Enter the account number(s) of the original owner and their name. Include the Social Security Number of the original owner and the date of death (in MM/DD/YYYY format). If the beneficial owner is a minor, include ‘minor’ after their name with the parent's or legal guardian's name.

- Navigate to the distribution option section. Select the appropriate distribution option based on your relationship to the original account owner and the type of account (Roth IRA or Traditional IRA). Review the options such as lump-sum, 5-year rule, or life expectancy distributions, and select one that fits your situation.

- If requesting a one-time distribution, specify the dollar amount or percentage for the distribution or close account options based on the funds listed.

- For setting up automatic withdrawals, indicate the start date for the automatic withdrawal plan and the frequency of distributions. Provide details for your distributions from the selected funds under your account.

- Select a payment method for your distribution, whether by check mailed to your address or transferred to a bank account. If choosing to deposit to a bank account, ensure to attach a voided check or deposit slip with your details preprinted.

- Complete the tax withholding information section, opting for federal and state withholding as needed. Consult with a tax professional for guidance on appropriate withholding based on your specific situation.

- Finally, sign the form, ensuring to include the date. If applicable, obtain a Medallion Signature Guarantee for distributions meeting certain criteria, such as being over $100,000 or sent to a different address. Confirm that you have provided accurate information and are aware of the tax liabilities associated with the distribution.

Complete your Inherited Retirement Account Distribution Request online today!

If you inherit a Roth IRA that was funded for 5 years or more prior to the death of the original owner, distributions can be taken tax-free. ... On the other hand, when you take money out of an inherited IRA, it will generally be taxed as ordinary income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.