Loading

Get Vat - 12b - Return For Composite Dealers.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT - 12B - Return For Composite Dealers.doc online

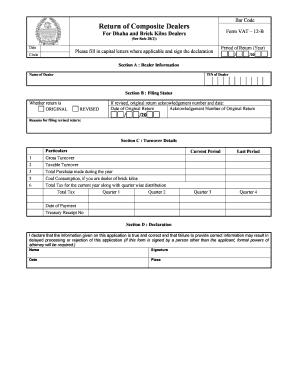

Filing the VAT - 12B return is an essential process for composite dealers. This guide provides you with clear, step-by-step instructions on how to complete the form online, ensuring accurate submission and compliance with regulations.

Follow the steps to complete the VAT - 12B return efficiently.

- Press the ‘Get Form’ button to access the VAT - 12B form and open it in your designated editor.

- In Section A, fill in your dealer information. Provide your name and Tax Identification Number (TIN) in the respective fields. Ensure that all information is accurate.

- Proceed to Section B to indicate your filing status. Choose whether your return is original or revised by selecting the appropriate option. If you are filing a revised return, enter the acknowledgement number and date of the original return.

- In Section C, detail your turnover information. For each category listed, such as gross turnover and taxable turnover, enter the appropriate figures for the current period and any related information, including coal consumption, if applicable.

- Continue in Section C by providing the total tax for the current year and its quarter-wise distribution. Fill in the date of payment and the treasury receipt number.

- Finally, complete Section D by reading the declaration statement carefully. If applicable, sign the form, provide the date and place of signing.

- Once you have filled out all sections of the form completely and accurately, save any changes you have made. You can then download the form, print it, or share it as needed.

Complete your VAT - 12B return online now to ensure timely filing and compliance.

However, if you have applied for the composition scheme GST, filing gets easier as you need to file just one quarterly return (GSTR 4) and one annual return (GSTR 9A). Upon registering for the composition scheme under GST, you are liable to pay tax at a fixed rate of 1% to 6% of your turnover.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.