Loading

Get Zakat Calculation Form - Kzct - Kzct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the ZAKAT CALCULATION FORM - KZCT - Kzct online

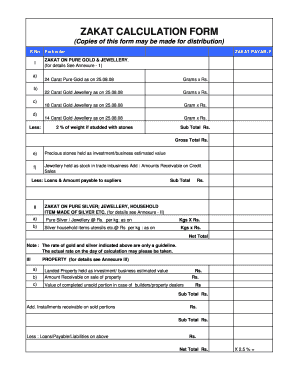

The ZAKAT CALCULATION FORM - KZCT - Kzct is an essential tool for individuals seeking to calculate their Zakat obligations accurately. This comprehensive guide provides clear, step-by-step instructions for users to complete the form online, ensuring a smooth and efficient process.

Follow the steps to fill out the Zakat calculation form effectively.

- Click the ‘Get Form’ button to obtain the Zakat calculation form and open it in your preferred editor.

- Begin by completing Section I, which pertains to Zakat payable on pure gold and jewellery. Enter the weight and values corresponding to 24 Carat, 22 Carat, 18 Carat, and 14 Carat gold. If applicable, include any deductions for items studded with stones.

- Proceed to Section II to report Zakat on pure silver and related items. Input the weights and values for pure silver jewellery and household items.

- In Section III, declare your investment properties. Enter values for landed properties and amounts receivable from property sales. Include liabilities to assess your net total for this section.

- Complete Section IV for business stock. Indicate the value of stock and any amounts receivable, subtracting debts and payables to arrive at your business stock net total.

- For Section V, report Zakat on shares in partnership firms. Include balance amounts, any loans advanced, and your share of profits up to the valuation date.

- In Section VI, provide details about cash in hand and bank, including savings and fixed deposits.

- Section VII involves Zakat on loans or investments. Enter your receivables from friends, investments, and government securities, calculating the net total.

- Fill in Section VIII for Ushur on agricultural produce by reporting crop values based on the source of water used for cultivation.

- In Section IX, detail Zakat on animals, specifying values based on the criteria outlined for different categories.

- Finally, in the general liabilities section, list any other debts, including income tax payable, to ascertain your overall Zakat payable amount.

- After completing all sections, review your entries for accuracy. You can then save changes, download, print, or share the completed form.

Take the next step in fulfilling your Zakat obligations by filling out your Zakat calculation form online today.

Zakat is applicable at a rate of 2.5% (or 1/40) of a Muslim's total savings and wealth above a minimum amount known as nisab and is calculated and paid annually. When to pay Zakat? Zakat is a yearly obligation for Muslims who had possession of the minimum amount of wealth (Nisab) for a complete lunar year (hawl).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.