Loading

Get Onslow County Tax Office - Address Change Request Form - Property Onslowcountync

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

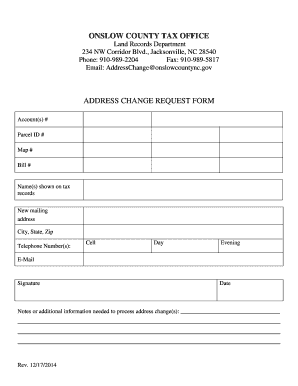

How to fill out the ONSLOW COUNTY TAX OFFICE - ADDRESS CHANGE REQUEST FORM - Property Onslowcountync online

Filling out the Onslow County Tax Office Address Change Request Form online is an essential process for individuals who need to update their property tax records. This guide provides clear, step-by-step instructions to ensure a smooth and efficient submission.

Follow the steps to correctly complete the address change request form

- Click the ‘Get Form’ button to access the form. This will open the document in an online editor for your convenience.

- Begin by entering the account number(s) associated with your property. This information is typically found on previous tax documents.

- Next, find the parcel ID number, which is a unique identifier for your property. Ensure to input the correct details to avoid processing delays.

- Provide the map number, as required. If you are uncertain about this number, it can often be located on the property deed or previous correspondence from the tax office.

- List the names as they appear on the tax records. This ensures that the update is accurately reflected in the system.

- Enter your new mailing address, including the city, state, and zip code. Verify that the address is complete and correct to facilitate effective communication.

- Fill out your email address in the specified field for electronic communication about your request.

- Sign and date the form. Your signature is required to validate your request for an address change.

- If you have any notes or additional information necessary for processing your address change, include them in the provided space.

- After completing all fields, review your entries for accuracy. You can then save the changes, download the document, print it, or share it as needed.

Complete your address change request online today for a hassle-free update!

Food Tax. The 2% Food Tax is charged on retail sales and purchases of qualifying food. Purchases of nonqualifying foods are subject to the general rate of State tax and the applicable local tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.