Loading

Get Massmutual Change Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MassMutual Change Form online

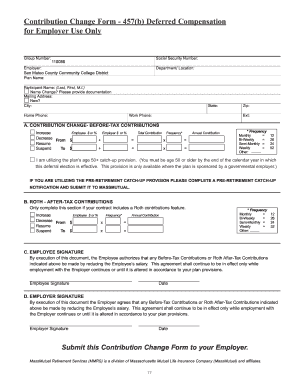

Completing the MassMutual Change Form online allows users to efficiently manage their contribution preferences for their deferred compensation plan. This guide provides step-by-step instructions to help users navigate each section of the form with clarity and ease.

Follow the steps to complete the MassMutual Change Form online.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Begin by entering your group number and social security number in the designated fields. This information is essential for identification and processing.

- Fill in the employer's name and department/location as required by the form. Ensure this information is accurate for your records.

- Provide your plan name and your personal details, including your last name, first name, and middle initial. If there has been a name change, please include the necessary documentation.

- Enter your mailing address, including city, state, and zip code. If your mailing address is new, indicate this clearly.

- Include your home phone and work phone numbers in the respective fields for contact purposes.

- For section A concerning before-tax contributions, specify whether you want to increase, decrease, resume, or suspend contributions. Fill in the employee and employer contribution amounts or percentages as applicable.

- Indicate the frequency of contributions by selecting the appropriate option, and calculate the annual contribution based on the provided formulas.

- If eligible, check to confirm you are utilizing the plan’s age 50+ catch-up provision. For pre-retirement catch-up options, be sure to follow up with the necessary notification as detailed in the form.

- For section B, complete the Roth after-tax contributions section only if your contract includes this feature. Follow the same steps as in section A for adjustments.

- Next, proceed to the signature section. The employee must sign and date the document, authorizing the contributions as indicated.

- The employer must also sign and date the document, confirming agreement with the listed contributions.

- Finally, submit the completed Contribution Change Form to your employer. This ensures your changes are processed timely.

Complete your forms online today to streamline your contribution management.

Once you are enrolled in a plan with your new employer, it's simple to rollover your old 401(k). ... However, you must deposit the funds into your new 401(k) within 60 days to avoid paying income tax on the entire balance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.