Loading

Get Beneficiary Questionnaire Fhlbc Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Beneficiary Questionnaire Fhlbc Pdf online

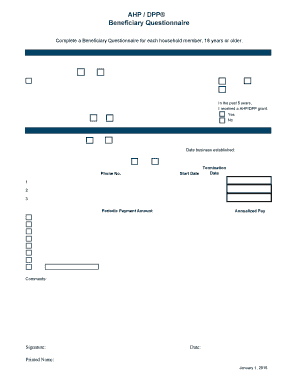

Filling out the Beneficiary Questionnaire Fhlbc Pdf is an important step for each household member interested in participating in a homeownership program. This guide will provide you with a clear, step-by-step approach to complete the form accurately and efficiently.

Follow the steps to fill out the Beneficiary Questionnaire Fhlbc Pdf online:

- Click ‘Get Form’ button to obtain the form and open it in the designated editing space.

- Begin by entering the name of the household member who is filling out the questionnaire. Ensure that you provide complete and accurate information.

- Indicate whether the individual is currently a student by selecting 'Yes' or 'No' and provide their age.

- Provide the total number of household members.

- If the individual is a student, specify the anticipated graduation date. If not, select 'No'.

- Confirm that the home being purchased will serve as the primary residence by selecting 'Yes'.

- Select the marital status from the given options: Married, Separated, Unmarried (includes Single, Divorced, Widowed).

- Answer if the individual is a first-time homebuyer by selecting 'Yes' or 'No'. Review the conditions to determine eligibility.

- Proceed to the employment section and indicate current employment status (Yes/No). If unemployed, provide the date of the last position held.

- For self-employed individuals, enter the name of the business and the date it was established.

- Provide the employer's name, phone number, position, start date, termination date, and pay frequency if currently employed.

- Disclose any pending employment or income changes and provide details if applicable.

- Complete information regarding other income sources, such as unemployment benefits, social security, disability, child support, etc.

- Read the certification statement and sign, including the printed name and date.

- Once all fields are completed, save your changes, download the form if needed, or share it as required.

Start filling out your Beneficiary Questionnaire Fhlbc Pdf online now!

Minimum down payment in Wisconsin: The minimum down payment a borrower may put down on a home in Wisconsin depends on the loan. The down payment can be as low as 0% (USDA and VA loans), 3% (Conventional loans), or 3.5% (FHA loans).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.