Loading

Get Consignors Report - Revenue Ky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CONSIGNORS REPORT - Revenue Ky online

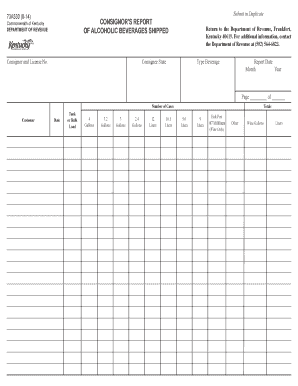

The CONSIGNORS REPORT - Revenue Ky is essential for documenting the shipment of alcoholic beverages within the Commonwealth of Kentucky. This guide provides clear and supportive instructions for completing the form accurately and efficiently online.

Follow the steps to successfully fill out the CONSIGNORS REPORT online.

- Click ‘Get Form’ button to access the CONSIGNORS REPORT template and open it for editing.

- Begin by entering the consignor's name and license number in the designated fields. Ensure that you provide accurate information as it is critical for processing your report.

- In the 'Consignee State' section, fill in the state that will receive the shipment. This helps in tracking and managing the distribution of alcoholic beverages.

- Specify the type of beverage being shipped from the provided options. Be clear and precise to avoid any confusion regarding your shipment.

- Fill in the report date, ensuring to select the correct month and year when the shipping occurred. Accurate dates are important for record-keeping purposes.

- In the 'Number of Cases' section, enter the total number of cases being shipped. Double-check your count for accuracy.

- Provide the customer's name in the appropriate field, as this identifies the recipient of the shipment.

- Enter the date of the shipment in the respective field, confirming it aligns with the report date.

- Indicate the load type—'tank' or 'bulk'—based on how the beverages are packaged for transport.

- Input the different quantities of beverages shipped in the correct measurement units (gallons, liters, etc.) in the specified fields, ensuring to adhere to the correct formats.

- At the bottom of the report, total the amounts entered in the various sections to provide a final count for gallons and liters.

- Once all fields are completed, review the form for accuracy and completeness before saving your changes. You can choose to download, print, or share the completed report as needed.

Start completing the CONSIGNORS REPORT online to ensure your shipment of alcoholic beverages is properly documented.

What is the federal tax on alcohol? The federal tax on spirits is $13.50 per proof gallon, which is defined as one gallon of liquid that is 50% alcohol). For wine, the rates vary based on alcohol content and can range from $1.07 per gallon on products with 16% or less alcohol to $3.40 for sparkling wines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.