Loading

Get Boe 401-ez Short Form Sales And Use Tax Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BOE 401-EZ Short Form Sales And Use Tax Form PDF online

This guide will assist users in successfully completing the BOE 401-EZ Short Form Sales And Use Tax Form PDF online. Following these step-by-step instructions ensures compliance and accuracy in reporting sales and use tax.

Follow the steps to complete the form online.

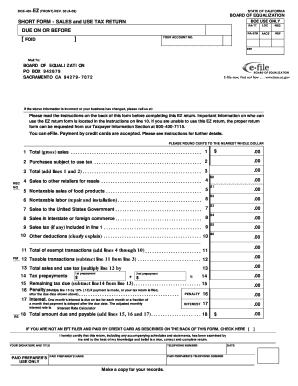

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the initial section regarding incorrect information or business changes. Ensure that your account number is correctly displayed.

- Begin at line 1 to report total (gross) sales. Enter the total sales related to your California business.

- Move to line 2 to enter purchases subject to use tax. Include merchandise and equipment you bought without paying California sales tax, used for business purposes.

- Proceed to line 3 to calculate total sales and purchases by adding the amounts from lines 1 and 2.

- Continue with lines 4 to 10, providing deductions for sales to other retailers, nontaxable sales, and any other applicable deductions. Clearly explain any amounts entered.

- On line 11, calculate the total of exempt transactions by adding lines 4 through 10.

- Move to line 12 and determine taxable transactions by subtracting line 11 from line 3.

- Calculate total sales and use tax on line 13 by multiplying the result on line 12 by the applicable tax rate.

- Complete line 14 for any tax prepayments, if required, as outlined in the form instructions.

- Subtract line 14 from line 13 on line 15 to determine the remaining tax due.

- If applicable, calculate any penalties on line 16 for late payments and interest on line 17 for delayed payments.

- On line 18, add lines 15, 16, and 17 to find the total amount due and payable.

- Certify the return with a signature and date, then save your completed form online.

- You can then download, print, or share the form as necessary.

Complete your documents online today for a hassle-free filing experience.

Purpose. Use form FTB 3500A, to obtain California tax-exempt status, if the organization has a federal determination letter granting exemption under IRC Sections 501(c)(3), 501(c)(4), 501(c)(5), 501(c)(6), 501(c)(7), or 501(c)(19).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.