Loading

Get 2013 Form 8815. Exclusion Of Interest From Series Ee And I U.s. Savings Bonds Issued After 1989

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Form 8815. Exclusion of interest from Series EE and I U.S. Savings Bonds issued after 1989 online

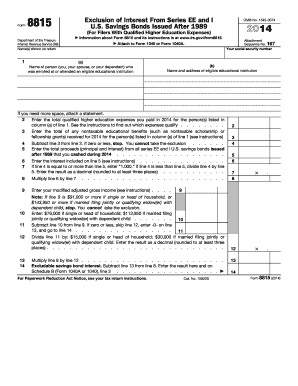

Filing the 2013 Form 8815 allows individuals to exclude interest earned from certain U.S. Savings Bonds under specific conditions. This guide provides a clear, step-by-step approach to filling out the form to ensure users can accurately report their information online.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- In section 1, list the name of the person, whether it's you, your partner, or a dependent, who was enrolled at or attended an eligible educational institution.

- In column (b) of section 1, enter the name and address of the eligible educational institution. List all institutions attended if there are multiple.

- On line 2, enter the total qualified higher education expenses you paid for the individual listed in line 1 during 2014. Ensure these expenses meet the qualifications as detailed in the instructions.

- On line 3, enter the total of any nontaxable educational benefits received for the individual listed. This may include scholarships or fellowship grants.

- Subtract line 3 from line 2 and enter the result on line 4. If the result is zero or less, you cannot take the exclusion.

- On line 5, enter the total proceeds from all Series EE and I U.S. Savings Bonds issued after 1989 that you cashed during 2014.

- On line 6, enter the interest included in line 5.

- Calculate the decimal for line 7. If line 4 is greater than or equal to line 5, enter ‘1.000’. If it’s less, divide line 4 by line 5 and enter the result.

- On line 8, multiply the amount on line 6 by the decimal obtained in line 7.

- On line 9, enter your modified adjusted gross income, ensuring you reference the appropriate IRS instructions.

- Continue through lines 10 to 14, as instructed, calculating any necessary values and entering them accurately.

- Once all lines are filled out, review the form thoroughly for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your 2013 Form 8815 online today to ensure you accurately benefit from the exclusion of interest from your savings bonds.

Qualified education expenses include only tuition and fees - not room and board. You also can include any contribution you make to a qualified state prepaid tuition program or to a Coverdell education saving account as an educational expense.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.