Loading

Get Ggstreturn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ggstreturn online

This guide provides a comprehensive, step-by-step approach to filling out the Ggstreturn online. By following these instructions, you can ensure that your GST submission is accurate and complete.

Follow the steps to successfully complete your Ggstreturn online.

- Press the ‘Get Form’ button to obtain the Ggstreturn form and open it in your preferred browser or document editor.

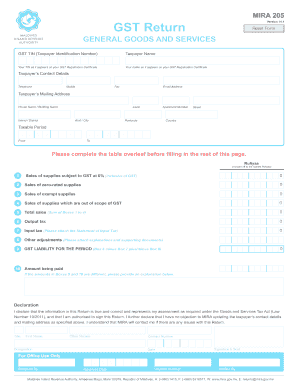

- Begin by entering your GST TIN (Taxpayer Identification Number) as it appears on your GST Registration Certificate. Then, input your name exactly as shown on that certificate.

- Fill in your contact details, including mobile number, telephone number, email address, and fax number.

- Provide your mailing address by specifying house/building name, level, apartment number, street, and country, along with the island/district and postcode.

- Indicate the taxable period by entering the start and end dates in the format of day, month, and year.

- Complete the revenue table by entering the appropriate figures for sales of supplies subject to GST at 6%, sales of zero-rated supplies, sales of exempt supplies, and sales of supplies which are out of scope of GST.

- Calculate and enter the total sales in the designated field by summing the values from boxes 1 through 4.

- Input the output tax and input tax as applicable. Attach the Statement of Input Tax and any necessary supporting documents for other adjustments.

- Determine the GST liability for the period by performing the calculation: Box 6 minus Box 7 plus/minus any adjustments from Box 8.

- Lastly, complete the declaration section by confirming that the information provided is accurate. Include your title, first name, other names, contact number, designation, and date. Sign and seal the form as required.

- Once you have reviewed your entries, save your changes, and proceed to download, print, or share the form as needed.

Complete your Ggstreturn documents online to ensure compliance and efficiency.

GST return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.