Loading

Get Form Rd 3555-21request For Sfh Loan Guaranteedraft Final04-28-2014 Revision

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RD 3555-21 Request for SFH Loan Guarantee online

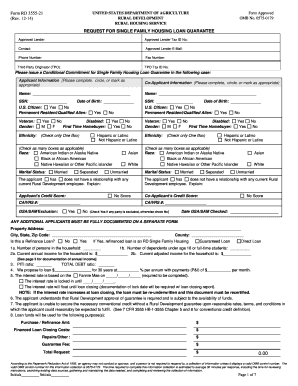

This comprehensive guide offers step-by-step instructions for successfully completing the Form RD 3555-21, which is essential for obtaining a Single Family Housing Loan Guarantee. Users will find detailed information on each section and field of the form to facilitate a smooth application process.

Follow the steps to efficiently complete your loan guarantee request form.

- Click ‘Get Form’ button to obtain the form and access it within your editor for completion.

- Begin entering the applicant information. Fill in the name, Social Security Number (SSN), date of birth, and mark the appropriate boxes concerning U.S. citizenship, veteran status, and if the applicant is a disabled person.

- Proceed to complete the co-applicant information section using the same format as above, ensuring accuracy in the provided details.

- Indicate whether this is a refinance loan and provide the property address, city, state, and zip code in the designated fields.

- In the household information section, input the number of persons and dependents, as well as the current annual and adjusted income figures.

- Calculate and enter the proposed loan amount, interest rate, and monthly payment details, ensuring all calculations are correct.

- Ensure that all certifications and acknowledgments are signed by both the applicant(s) and the authorized lender representative, including signing and dating the necessary fields.

- Review the entire form for accuracy before proceeding to save your changes.

- After completing the form, you can save changes, download a copy for your records, print it, or share it as needed.

Complete your Form RD 3555-21 online and ensure a smooth application process for your loan guarantee.

15.4 ELECTRONIC SIGNATURES The 7 CFR 3555 rule does not prohibit or consent to electronic signatures. Lenders may use electronic signatures when the lender perfects and maintains a first lien position, an enforceable promissory note, and meets all other agency requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.