Loading

Get For Governmental Plans

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For Governmental Plans online

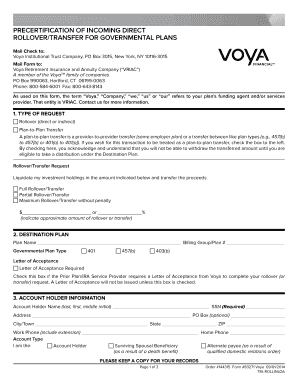

Filling out the For Governmental Plans form requires careful attention to detail to ensure a smooth rollover or transfer of your retirement benefits. This guide will help you navigate the sections of the form and provide clear instructions to complete it accurately.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Review the form’s instructions thoroughly to understand the requirements for your rollover or transfer request. Ensure you have your account information and any necessary documentation handy.

- Accurately fill out all required fields, including your personal details, account holder information, and specifics related to your prior plan or IRA service provider. Validate the pre-filled information if applicable.

- Check the relevant type of request, whether it is a rollover or plan-to-plan transfer, and indicate if a letter of acceptance is required by your prior provider.

- Attach a copy of your most recent statement from the account you are rolling over to verify the eligibility for transfer.

- Sign and date the completed form, confirming that all information is correct and that you certify your rollover or transfer request complies with applicable regulations.

- Mail or fax the completed form along with any attachments to Voya at the specified address or fax number provided in the instructions.

- After submission, you may follow up by contacting Voya to ensure your request is being processed correctly and to check on any additional steps if necessary.

Complete your documents online to streamline your rollover process today.

The 401k is different from the 401a. In 401a plans, the employer and employee make monthly contributions. But in the 401k, only employees make monthly contributions. The employer doesn't need to contribute to that plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.