Loading

Get Itr Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Itr Form online

This guide provides a comprehensive overview of how to fill out the Itr Form electronically. Following the steps outlined will ensure that you efficiently complete the form and comply with necessary requirements.

Follow the steps to successfully complete the Itr Form online.

- Click ‘Get Form’ button to access the Itr Form and open it in your preferred editor.

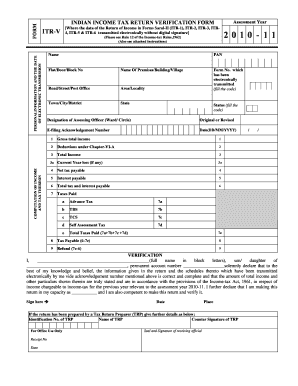

- Fill in your personal information, including your name and PAN (Permanent Account Number). Ensure that all details are accurate and up to date.

- Indicate the assessment year for which you are submitting the form (e.g., 2010-11).

- Complete the gross total income section, ensuring to detail all sources of income accurately.

- Enter deductions under Chapter VI-A, if applicable, to arrive at the total income.

- Provide details on the computation of income and tax, including current year losses, net tax payable, and interests.

- Fill in the taxes paid section, detailing advance tax, TDS, TCS, and any self-assessment tax paid.

- Calculate the total tax and interest payable, and determine if there is any outstanding tax or refund.

- In the verification section, provide your name in block letters, your relationship, and accurately affirm that the information provided is correct.

- If your return was prepared by a Tax Return Preparer (TRP), include their name and identification number, and ensure it's countersigned.

- Once the form is completed, save your changes and download a copy for your records.

- Print two copies of the completed form. Sign one copy and send it by ordinary post to the specified address.

- Retain the second copy for your personal records as proof of submission.

Complete your electronic Itr Form online today to ensure timely filing and compliance.

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.