Loading

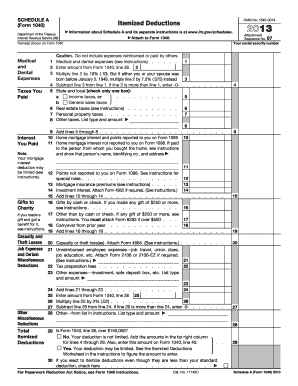

Get 2013 Form 1040 (schedule A) - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Form 1040 (Schedule A) - Internal Revenue Service online

Filling out the 2013 Form 1040 (Schedule A) for itemized deductions is a crucial step in preparing your tax return. This guide offers a detailed, step-by-step approach to assist you in accurately completing the form online.

Follow the steps to complete your Schedule A efficiently.

- Press the ‘Get Form’ button to access and open the form in your preferred online platform.

- Begin by entering your name(s) as shown on Form 1040 at the top of Schedule A.

- In the 'Medical and dental expenses' section, input your total medical and dental expenses on line 1. Refer to the instructions to ensure you are including only allowable expenses.

- On line 2, transfer the amount from Form 1040, line 38. This is your adjusted gross income.

- Calculate the threshold by multiplying the amount on line 2 by 10% (or 7.5% if applicable, based on age) and enter it on line 3.

- Next, subtract line 3 from line 1 and enter the result on line 4. If line 3 exceeds line 1, enter -0-.

- For the 'Taxes You Paid' section, check the box that corresponds to the type of state and local taxes you paid on line 5, and list any additional taxes on lines 6-8.

- In the 'Interest You Paid' section, report your home mortgage interest on lines 10-13, ensuring you have necessary Form 1098, if required.

- Label any charitable contributions on lines 16-18. Be sure to retain necessary records for contributions of $250 or more.

- If applicable, complete the 'Casualty and theft losses' section by entering details and attaching Form 4684, if necessary.

- In the 'Job Expenses and Certain Miscellaneous Deductions' section, include any unreimbursed employee expenses or other miscellaneous deductions as required.

- Finally, total your itemized deductions on line 29. Review if your deductions need to be limited based on your income, and mark the appropriate box on line 30.

- Once completed, ensure all entries are accurate. You can now save changes, download, print, or share the form.

Complete your tax forms online today to ensure accurate and timely filing.

Schedule A is an income tax form that U.S. taxpayers use to report their tax-deductible expenses in order to reduce the amount of money they owe. The Schedule A form is an optional attachment to the standard 1040 form for U.S. taxpayers reporting their annual income taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.