Loading

Get What Is A Sworn Statement Of Dependency On The Deceased Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the What Is A Sworn Statement Of Dependency On The Deceased Form online

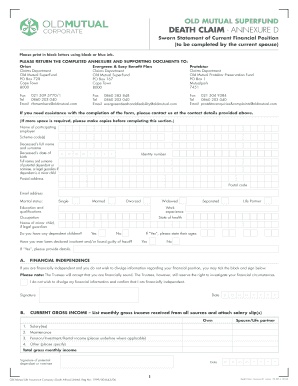

Filling out the Sworn Statement Of Dependency On The Deceased Form is an important process when claiming benefits after the death of a member. This guide provides clear and instructive steps to assist you in completing the form online effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This allows you to start filling out the document online.

- Begin by entering the name of the participating employer, along with the scheme code(s). This information is crucial for the processing of your claim.

- Provide the deceased’s full name and surname, as well as their date of birth. Ensure that the date format is accurate.

- List the full names and surname of the potential dependant or nominee, or legal guardian if the dependant is a minor child. Include their identity number and contact details.

- Indicate the marital status by selecting the appropriate option, and proceed to list educational qualifications and work experience. Clearly fill out the occupation and state of health.

- If applicable, state the name of the minor child under your guardianship and whether there are any dependent children. You should also indicate if there has been any prior declaration of insolvency or fraud.

- For the financial independence section, you may opt not to disclose your financial position. If you choose to disclose, provide details regarding your monthly gross income from all sources, which includes salary, maintenance, pensions, and any other income.

- List all monthly expenses, ensuring to be comprehensive in capturing all deductions, routine living costs, and any liabilities.

- Detail all assets you own, including properties and investments, in the designated section. Also, list all liabilities, highlighting any debts and their outstanding amounts.

- Describe any benefits expected as a result of the deceased’s death, including inheritance or policies you are a beneficiary of. Provide all necessary details about these benefits.

- Complete the sworn declaration, affirming the accuracy of the information provided. This section requires your signature and the date.

- Once all fields are completed and verified for accuracy, save your changes. You may also choose to download, print, or share the form as needed.

Complete your documents online today to ensure a smooth claims process.

Most often, a copy of the deceased spouse's death certificate, the notarized death affidavit, and a legal description of the property are required. Once these steps are complete, your deceased spouse will have been removed and you will be the sole owner on the deed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.