Loading

Get W-8ben-e(sp) - Scotiabank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-8BEN-E(SP) - Scotiabank online

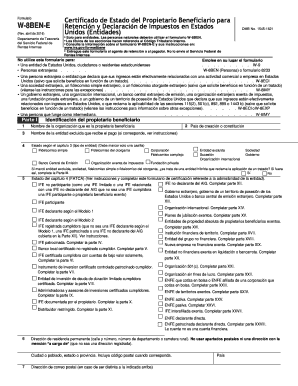

The W-8BEN-E(SP) form is essential for entities that need to certify their foreign status for withholding tax purposes in the United States. This guide will provide clear steps on how to complete this form online, ensuring you understand each section and can submit it with confidence.

Follow the steps to fill out the W-8BEN-E(SP) - Scotiabank online

- Press the ‘Get Form’ button to download the W-8BEN-E(SP) form and open it in your preferred editor.

- Provide the name of the organization that is the beneficial owner in the first field.

- Enter the country of incorporation or organization in the next section.

- Indicate the chapter 3 status by selecting the appropriate box for your entity type, ensuring you only select one.

- If applicable, answer whether the excluded entity is a hybrid entity claiming treaty benefits by checking 'Yes' or 'No'.

- Complete the chapter 4 status section according to the instructions, marking the appropriate box that corresponds to your entity's FATCA status.

- Fill in the permanent residence address, including street, city, and ZIP code, making sure not to use a P.O. Box.

- If the mailing address differs from the permanent address, provide the postal address in the designated fields.

- Input the U.S. taxpayer identification number if required, along with the global intermediary identification number.

- Carefully review the remaining sections, providing detailed information as necessary, especially in areas related to tax treaty benefits, entity classification, and certifications.

- Once all required sections are completed, sign and date the form in the specified area.

- Finally, save the changes to the form, and you can choose to download, print, or share it as needed.

Start filling out the W-8BEN-E(SP) form online today to comply with your tax obligations.

W-8BEN-E is an important tax document which allows businesses operating outside of the U.S. to claim tax exemption on U.S.-sourced income. The official document title is Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.