Loading

Get Commercial Business Property Return - State Of West Virginia - State Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Commercial Business Property Return - State Of West Virginia online

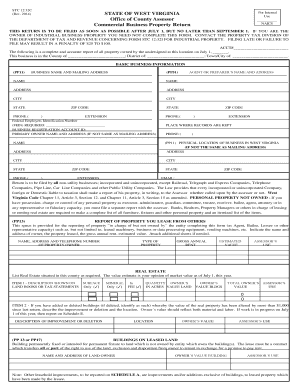

Filling out the Commercial Business Property Return for the state of West Virginia is an essential task for businesses to report their property accurately. This guide provides clear, step-by-step instructions to help users complete the form efficiently and correctly.

Follow the steps to complete your Commercial Business Property Return online:

- Press the ‘Get Form’ button to access the Commercial Business Property Return and open it in your preferred editor.

- Begin by filling in your account number, which allows for the identification of your property records.

- Provide the basic business information, including the business name and mailing address. Be sure to also include the primary owner's name and address if it differs from the mailing address.

- Report the physical location of your business in West Virginia, including the complete address and the place where your records are kept.

- Indicate the Federal Employers Identification Number (FEIN) and the Business Registration Account ID in the designated fields.

- If applicable, list all property that you lease from others, ensuring that you provide details such as the type of property, the owner’s name, contact information, and the annual rent.

- Fill out the real estate section by describing your property as recorded on tax statements. Mark the appropriate boxes for the type of property (surface, mineral) and report the property's estimated market value.

- For any improvements made to the property since the last return, provide descriptions and values for changes exceeding $1,000, whether they are additions or deletions.

- In the machinery and equipment section, report all owned property by year, including acquisition costs and values, ensuring to include any leasehold improvements.

- Complete sections for inventory, parts, and supplies by listing all relevant items, acquisition costs, and values, following the directions provided in the schedules.

- Before submission, review all entries for accuracy, attach any required supplementary documents such as depreciation schedules or balance sheets, and ensure that any necessary signatures are included.

- Finally, save any changes, and choose to download, print, or share your completed form.

Complete your Commercial Business Property Return online now to ensure compliance and avoid penalties.

West Virginia charges corporations a flat, 6.5% income tax. If your company is organized as a traditional, or C corporation, you can expect to pay this as your West Virginia business tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.