Loading

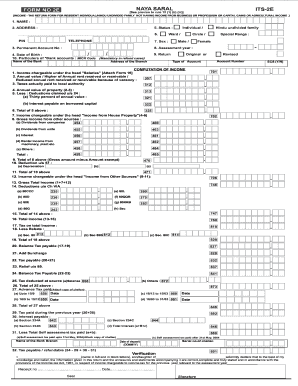

Get Naya Saral Its 2e Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Naya Saral Its 2e Form online

The Naya Saral Its 2e Form is essential for individuals and Hindu undivided families who need to file their income tax returns without income from business or agricultural sources. This guide aims to provide a comprehensive step-by-step process to help you complete the form efficiently online.

Follow the steps to fill out the Naya Saral Its 2e Form online

- Press the ‘Get Form’ button to access the Naya Saral Its 2e Form and open it in your editor.

- Fill in your full name in the designated field. This is the name under which you are filing your income tax return.

- Provide your current address along with the postal PIN code. Ensure all information is accurate to avoid any processing delays.

- Enter your Permanent Account Number (PAN) in the specified section. This number is crucial for identification in the income tax system.

- Input your date of birth in the format indicated to confirm your identity and age.

- Select your status as either an individual or Hindu undivided family, and indicate your gender in the appropriate field.

- Specify the assessment year for which you are filing the tax return. It should correspond with the financial year in question.

- Complete the section regarding bank account particulars, including the MICR code if applicable. This is necessary for any potential refunds.

- Proceed to declare your income sources, including dividends, rental income, and other specified areas. Follow the prompts as directed.

- Once all relevant fields are filled and reviewed for accuracy, you can choose to save changes, download the form, print it, or share it as needed.

Complete your Naya Saral Its 2e Form online today to ensure timely processing of your tax return.

Computation of income is a systematic presentation of all gains, exemptions, rebates, reliefs, deductions, and the computation of taxes in connection with the calculation of taxes. Although there is no standard format for this, the following elements are generally considered in the computation of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.