Loading

Get Form 1040n-mil - Nebraska Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 1040N-MIL - Nebraska Department Of Revenue online

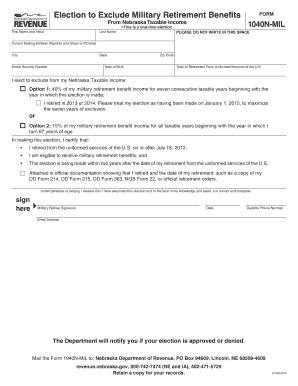

Filling out the Form 1040N-MIL is an important step for military retirees looking to exclude a portion of their retirement benefits from Nebraska taxable income. This guide provides clear, step-by-step instructions to help users navigate the process comfortably and effectively.

Follow the steps to complete your Form 1040N-MIL online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your first name, middle initial, and last name in the designated fields.

- Provide your current mailing address, including street address or P.O. box, city, state, and zip code.

- Enter your Social Security number and date of birth in the respective sections.

- Indicate the date of your retirement from the uniformed services of the U.S. in the provided field.

- Choose one of the two options for tax exclusion by checking the appropriate box. Option 1 allows you to exclude 40% of your military retirement income for seven consecutive taxable years, starting with the year the election is made. Option 2 allows for a 15% exclusion starting with the year you turn 67.

- If you are electing Option 1 and retired in 2013 or 2014, check the box that allows for treating your election as being made on January 1, 2015, to maximize your exclusion period.

- Certify your eligibility by confirming the statements regarding your retirement date and benefits. Make sure to attach official documentation verifying your retirement date, such as a copy of your DD Form 214 or similar documents.

- Sign and date the form, ensuring that you include your daytime phone number and email address for any follow-ups from the Department.

- After completing the form, you can save changes, download a copy, print it out, or share it as needed.

Complete your Form 1040N-MIL online today to make your election for tax exclusion simple and straightforward.

Nebraska law allows an individual who retires from the uniformed services of the U.S. to exclude from Nebraska taxable income a portion of his or her military retirement benefit income for tax years beginning on or after January 1, 2015.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.