Loading

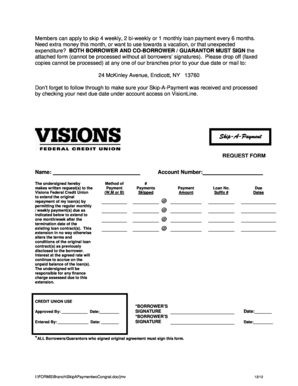

Get Visions Skip A Payment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Visions Skip A Payment online

This guide provides a comprehensive overview of the steps required to complete the Visions Skip A Payment form. Whether you need financial flexibility this month or want to allocate funds elsewhere, this guide will help you navigate the process smoothly.

Follow the steps to successfully complete your Skip A Payment request.

- Press the ‘Get Form’ button to access the Visions Skip A Payment form. This button will provide you with the necessary document in an online format.

- Begin by entering your name in the designated field. This identifies you as the borrower requesting the payment skip.

- Locate the account number section and input your specific loan account number. This is crucial for accurately processing your request.

- Select the method of payment by choosing W (weekly), B (bi-weekly), or M (monthly) for your loan payments. This will determine how many payments you plan to skip.

- Indicate the number of payments you wish to skip in the '# Payments Skipped' field. Ensure that this aligns with your selected payment method.

- Enter the payment amount in the 'Payment Amount' section. This should reflect the regular payment you make.

- List the loan numbers and suffixes for each loan that will be affected by this request in the 'Loan No. Suffix #' section.

- Provide the due dates of the payments you wish to skip as directed in the 'Due Dates' area. These should correspond to your regular payment schedule.

- Both the borrower and co-borrower/guarantor must sign the form where indicated. This is essential for processing your request.

- After completing the form, save your changes and proceed to download or print the document for your records. You can then submit it to the appropriate branch.

Complete your Visions Skip A Payment request online today for timely financial relief.

Flex Checking is a tiered rate account. What does that mean? It means that your checking account will flex with you depending on how you spend!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.