Loading

Get Form N-210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form N-210 online

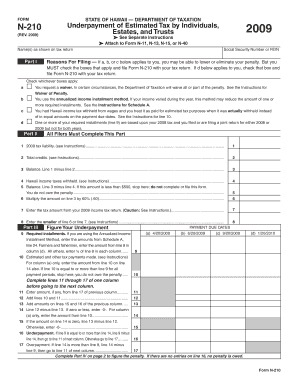

Filling out the Form N-210 is an important step for individuals, estates, and trusts who need to report underpayment of estimated tax. This guide provides clear instructions for completing the form online to ensure accuracy and compliance with tax regulations.

Follow the steps to complete the Form N-210 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In the first section, 'Name(s) as shown on tax return', enter your name or the name of the entity as it appears on your tax documents.

- Provide your Social Security Number or FEIN in the designated field.

- In 'Reasons For Filing', check all applicable boxes based on your eligibility for penalty reduction or waiver. Ensure you thoroughly read each option and select those that pertain to your situation.

- Move to 'Part II' and fill in line 1 with your total tax liability for 2009 as instructed.

- Complete line 2 by entering your total credits and calculating the balance on line 3 by subtracting line 2 from line 1.

- Input any Hawaii income taxes withheld in line 4, and if the balance on line 5 is less than $500, stop here as no penalty is owed.

- Continue to lines 6 through 8 to calculate the required amounts, ensuring to follow the instructions provided for each.

- Proceed to 'Part III' to figure your underpayment by entering required installment amounts and estimated tax payments.

- Complete the columns for each payment date accurately, and follow through to line 17 for overpayment adjustments.

- Lastly, in 'Part IV', follow the instructions to calculate any penalties based on the underpayment and payment dates provided.

- Review all the fields for accuracy, then save your changes and choose to download, print, or share the completed form as needed.

Complete your Form N-210 online to ensure proper tax reporting and compliance.

505- Tax Withholding and Estimated Tax. If you do need to file Form 2210 you can find the form within the program by going to: Federal Section. Payments and Estimates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.