Loading

Get Application For Certificate Of Eligibility For Veterans Tax Exemption ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Certificate Of Eligibility For Veterans Tax Exemption online

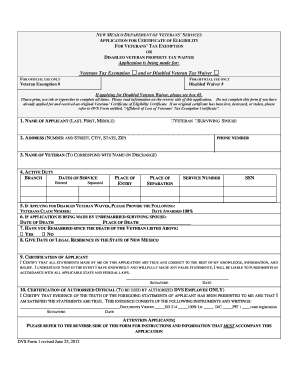

Completing the Application For Certificate Of Eligibility For Veterans Tax Exemption online can help you access important benefits as a veteran or surviving spouse. This guide will provide you with step-by-step instructions on how to complete the form effectively.

Follow the steps to complete the application accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill out the first section with your name by entering your last name, first name, and middle name as applicable.

- Next, provide your complete address, including the number and street, city, state, and zip code.

- Include your phone number for any necessary correspondence.

- In this section, state the name of the veteran as it corresponds to the discharge documentation.

- Select the appropriate branch of service and enter the dates of service, including 'Entered' and 'Separated' dates.

- Complete the place of entry and place of separation fields, followed by your service number and Social Security number.

- If you are applying for a Disabled Veteran Waiver, provide the veteran’s claim number and the date awarded 100%.

- If the application is from an unremarried surviving spouse, provide the date and place of death of the veteran.

- Indicate whether you have remarried since the veteran's death by selecting 'Yes' or 'No.'

- Enter the date of legal residence in New Mexico.

- Read the certification statement and ensure all information is true, then sign and date the application.

- If required, ensure the authorized official fills in their certification on behalf of the Department of Veterans Services.

- Review the additional instructions on the reverse side of the form for any necessary accompanying documents.

- Once the application is complete, save your changes, then download, print, or share the form as needed.

Start your application process online today to ensure you secure the veterans tax exemption benefits you deserve.

VA Form 26-8937 helps provide proof of veteran disability compensation or a non-service-connected pension. It also can help show whether the veteran has been rated by the VA as incompetent. ... The loan applicant's name entered on the form needs to match the records for a veteran disability or surviving spouse claim.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.