Loading

Get Form Ct-1120 Pic

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-1120 PIC online

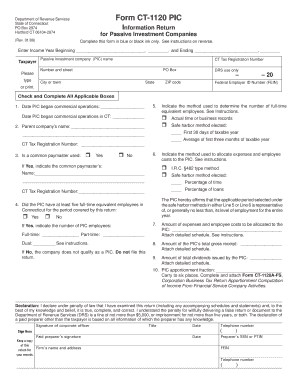

Filling out Form CT-1120 PIC online is an essential step for passive investment companies wishing to comply with Connecticut state regulations. This guide provides clear and comprehensive instructions to help users successfully complete the form.

Follow the steps to complete the Form CT-1120 PIC online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the income year at the top of the form, specifying both the beginning and ending dates.

- Provide the passive investment company's name along with its Connecticut Tax Registration Number and address details.

- Indicate the date when the PIC began commercial operations and when it began operations in Connecticut.

- Select the method used to determine the number of full-time equivalent employees—either through actual business records or a safe harbor method.

- Input the parent company's name and its Connecticut Tax Registration Number for identification.

- Respond to the question of whether a common paymaster is used, and, if so, provide the name and registration number.

- Indicate whether the PIC had at least five full-time equivalent employees during the reporting period.

- For companies with fewer than five full-time equivalent employees, note that they do not qualify as a PIC and should not file the return.

- Fill in the amount of expenses and employee costs to be allocated to the PIC, attaching a detailed schedule as required.

- State the total gross receipts of the PIC and include a detailed schedule.

- List the total amount of dividends issued by the PIC, again attaching any necessary detailed schedules.

- Complete the apportionment fraction for the PIC ensuring it carries to six decimal places.

- Finish by signing the declaration, including the signature of a corporate officer and the required details.

- Once completed, save any changes made, and consider downloading, printing, or sharing the form as needed.

Start completing your documents online today to ensure timely and accurate filing.

HOW TO OBTAIN CONNECTICUT TAX FORMS Connecticut state tax forms can be downloaded at the Department of Revenue Services (DRS) website: .ct.gov/drs/ Connecticut tax forms and publications are available at any DRS offices, during tax filing season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.