Loading

Get Schedule C Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule C Worksheet online

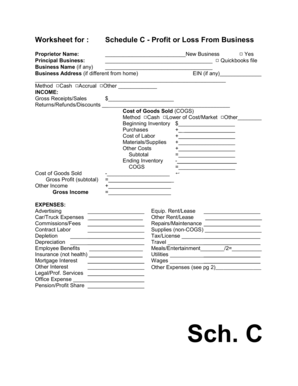

The Schedule C Worksheet is a crucial document for reporting profit or loss from business activities. This guide will provide clear, step-by-step instructions on how to accurately complete the worksheet online, ensuring users can effectively document their business income and expenses.

Follow the steps to accurately complete your Schedule C Worksheet.

- Click ‘Get Form’ button to obtain the Schedule C Worksheet and open it in the editor.

- Begin by entering your name as the proprietor and indicating if this is a new business by selecting 'Yes' or providing the name of an existing business and its address, if different from your home address.

- Enter your Employer Identification Number (EIN) if applicable, then select your method for accounting (cash, accrual, or other).

- In the income section, input your gross receipts or sales. If applicable, subtract any returns, refunds, or discounts from this amount.

- Complete the Cost of Goods Sold (COGS) section by choosing your accounting method. Enter values for beginning inventory, purchases, cost of labor, materials, supplies, and other costs, then calculate the subtotal and ending inventory to determine your COGS.

- Next, calculate your gross profit by subtracting COGS from the gross receipts. If you have any other income, add this in to find your gross income.

- Proceed to the expenses section by entering all relevant costs associated with your business, including advertising, car expenses, commissions, legal services, office expenses, and travel, among others.

- For asset depreciation and vehicle information, complete the necessary fields including asset descriptions, dates of service, business miles, total miles, and any related expenses.

- Continue with any additional expenses from Part V, and finally, enter the total other expenses, business use of home if applicable, total expenses, and calculate your net income or loss.

- Once all sections are complete, ensure that you've reviewed your entries for accuracy, save the changes, and choose your option for downloading, printing, or sharing the completed form.

Begin filling out your documents online today for an efficient filing experience.

Generally, you can't make tax claims without receipts. All of your claimed business expenses on your income tax return need to be supported with original documents, such as receipts. ... All a bank or credit card statement proves is that a payment was made it doesn't verify the nature of the expense.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.