Loading

Get Reg-3-mc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the REG-3-MC online

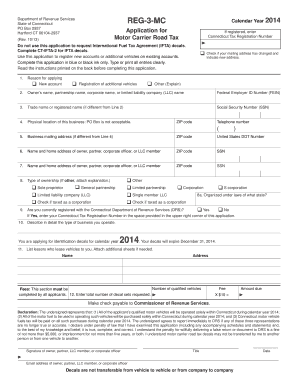

The REG-3-MC form is essential for motor carriers in Connecticut to apply for the Motor Carrier Road Tax. This guide provides a comprehensive overview of how to fill out the form online, ensuring you have all the information needed to complete your application correctly.

Follow the steps to complete your REG-3-MC application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by indicating your reason for applying. Select from the options provided such as 'New account', 'Registration of additional vehicles', or other reasons. If your mailing address has changed, mark the box and provide the new address.

- Enter the owner's name, partnership name, corporate name, or LLC name in the appropriate field. If applicable, include your Federal Employer Identification Number (FEIN) next to it.

- If your trade name or registered name differs from the previous entry, specify it here. Enter the Social Security Number (SSN) if you're a sole proprietor.

- Provide the physical location of your business. Note that PO boxes are not acceptable. Include the ZIP code and telephone number.

- If your business mailing address differs from the physical location, complete Line 5 with that information.

- List the name and home address of the owner, partner, corporate officer, or LLC member. Repeat this for another member if necessary.

- Identify the type of ownership of your business by choosing from the options provided, and enter the relevant Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as applicable.

- State the name of the state where your business is organized if applicable.

- Indicate whether you are currently registered with the Connecticut Department of Revenue Services (DRS) and input your Connecticut Tax Registration Number if so.

- Describe the type of business you operate in detail.

- List lessors who lease vehicles to you. Attach additional sheets if necessary.

- Complete the fees section by entering the total number of decal sets requested, multiplying the number of sets by $10 to determine the amount due.

- Review the declaration section, ensuring it is accurately completed and sign the application, providing the title, email address, and date.

- Once you have filled out all necessary sections, save your changes. You can then download, print, or share the completed form as needed.

Complete your REG-3-MC application online today to ensure timely processing of your motor carrier road tax decals.

“We've got a lot of expense when it comes to roads and bridges.” Starting Jan. 1, carriers using tractor-trailers have to pay between 2.5 cents and 17.5 cents for every mile driven in Connecticut, with the fee dependent on the gross weight of the vehicle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.