Loading

Get Self-employed Earnings Information Form - Shepway District Council - Shepway Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self-Employed Earnings Information Form - Shepway District Council - Shepway Gov online

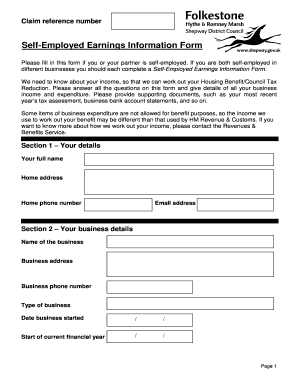

This guide aims to provide a detailed overview of how to accurately complete the Self-Employed Earnings Information Form required by Shepway District Council. Whether you are submitting your information for housing benefit or council tax reduction, following these steps will ensure that you provide all necessary details efficiently.

Follow the steps to successfully complete your form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in Section 1 - Your details. Include your full name, home address, home phone number, and email address. Accuracy in this section is crucial as it identifies you.

- Move to Section 2 - Your business details. Provide the name and address of your business, the business phone number, type of business, date your business started, and the start date of the current financial year. Make sure all information is correct and current.

- Answer the questions about your business structure, including whether you are a director and if your business is a partnership. If applicable, list the partners and their respective share percentages.

- In Section 3 - Accounts, indicate if you have prepared accounts for the last financial year. If yes, make sure to attach them. If no, provide an explanation and the date you expect to have them. For new businesses, include estimated accounts for the first three months.

- Provide your income/sales figures, detailing any enterprise allowance and closing stock. Then, list purchases to calculate your gross profit. Ensure all values are accurate.

- List your expenses in the same section, ensuring that only business-related expenses are included. Calculate the total expenses, gross profit, and net profit.

- If your business is running at a loss, fill out Section 4 with details on how long you expect this to continue and how you are managing living expenses without business income.

- If applicable, complete Section 5 regarding business directors with specifics about your pay and proof of earnings.

- Section 6 deals with deductions, including National Insurance and personal pension contributions. Provide any necessary proof of payments.

- If you are a taxi driver, complete Section 7 with relevant questions about mileage and car rental. Ensure to provide all necessary information.

- Finally, read the declaration in Section 8, ensuring you're aware of the legal implications. Sign and date the form.

- Once completed, you can save changes, download, print, or share the form as needed before submission.

Complete the Self-Employed Earnings Information Form online today for accurate assessment and benefits.

You will need your council tax account number to proceed with payment. Or you can use our automated payment line. It is available 24/7, the phone number is 01303 853394.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.