Loading

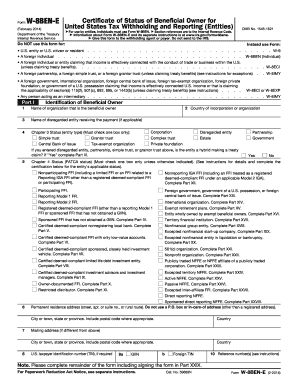

Get Form W-8ben-e Certificate Of Status Of Beneficial Owner For ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8BEN-E Certificate Of Status Of Beneficial Owner for online submission

Filling out the Form W-8BEN-E is essential for entities that are not U.S. persons to claim beneficial ownership for the purposes of U.S. tax withholding and reporting. This guide provides a straightforward, step-by-step process to complete the form online.

Follow the steps to complete the Form W-8BEN-E securely and accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the organization that is the beneficial owner in the designated field.

- If applicable, provide the name of any disregarded entity receiving the payment in the specified area.

- Select a Chapter 3 Status by checking one box only, indicating your entity type, such as partnership or corporation.

- Complete the section requiring the permanent residence address, ensuring that you do not use a P.O. box or in-care-of address.

- If your entity has a U.S. taxpayer identification number (TIN), fill in that information. If not, leave it blank as instructed.

- For Chapter 4 status under FATCA, check the appropriate box that applies to your entity's classification.

- Continue through the remaining sections of the form, making sure to fill out any applicable parts based on your entity's specific circumstances.

- Once all relevant sections are completed, review the entire form for accuracy before finalizing.

- At the end, ensure you sign and date the form in the certification area to validate your submission.

- After completing the form, you may save changes, download, print, or share it according to your needs.

Begin the process of completing your Form W-8BEN-E online today for smooth tax compliance.

The W-8BEN-E is an IRS mandated form to collect correct Nonresident Alien (NRA) taxpayer information for entities for reporting purposes and to document their status for tax reporting purpose.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.