Loading

Get Vda Fact Pattern Form - State Of New Jersey - Newjersey

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VDA Fact Pattern Form - State Of New Jersey - Newjersey online

Completing the VDA Fact Pattern Form for the State of New Jersey can be straightforward with the right guidance. This user-friendly guide will walk you through each section of the form, ensuring that you understand how to provide the necessary information accurately.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to acquire the document and open it for editing.

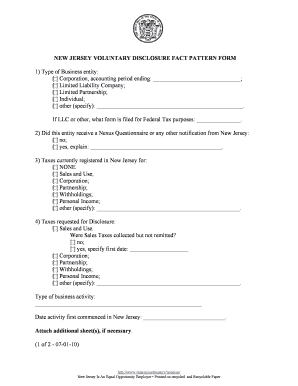

- Begin by selecting the type of business entity you represent. Choose from options including Corporation, Limited Liability Company, Limited Partnership, Individual, or Other. If you select 'Other', specify the type in the provided space. If your business is an LLC or falls under another category, indicate the form filed for Federal Tax purposes.

- Indicate whether your entity received a Nexus Questionnaire or any other communication from New Jersey by selecting 'Yes' or 'No.' If you select 'Yes,' provide a brief explanation in the space provided.

- Identify what taxes your entity is currently registered for in New Jersey. Options include NONE, Sales and Use, Corporation, Partnership, Withholdings, Personal Income, or Other. Select the appropriate options accordingly.

- Next, indicate the taxes you wish to disclose. If Sales Tax is among them, specify if any sales taxes were collected but not remitted. If so, indicate the first date of this occurrence.

- Describe your business activity in the designated space, providing relevant details about the nature of your operations.

- Record the date when your business activity first commenced in New Jersey.

- If needed, attach additional sheets for further information or explanation related to your responses.

- Provide the contact details for the person responsible, including the contact person's name, firm name, mailing address, phone number, fax number, and email address.

- Finally, sign and date the form. Once completed, make sure to return the form to the appropriate address provided for submission.

Begin filling out your VDA Fact Pattern Form online today!

The New Jersey Voluntary Disclosure Program allows Individual and Business taxpayers that have tax filing obligations or business activities that create nexus for New Jersey Tax purposes to come forward and file the appropriate tax return(s) and registration forms, and pay outstanding tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.